Chart Of Accounts Nonprofit

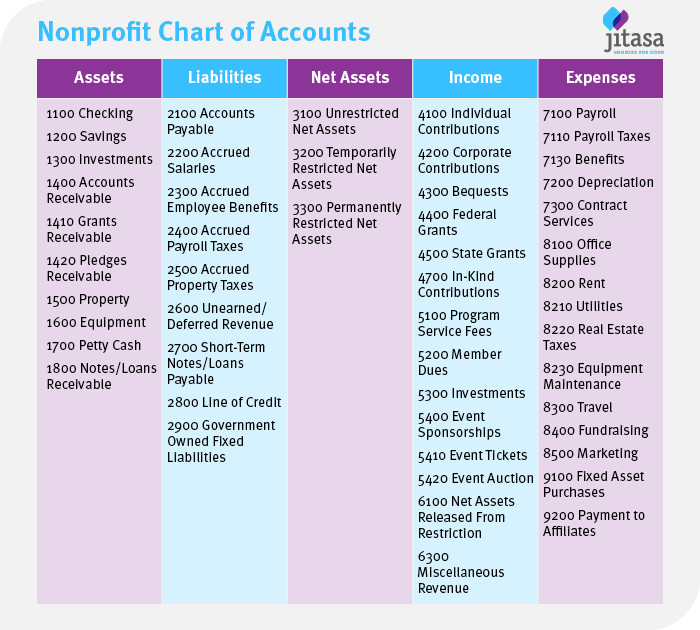

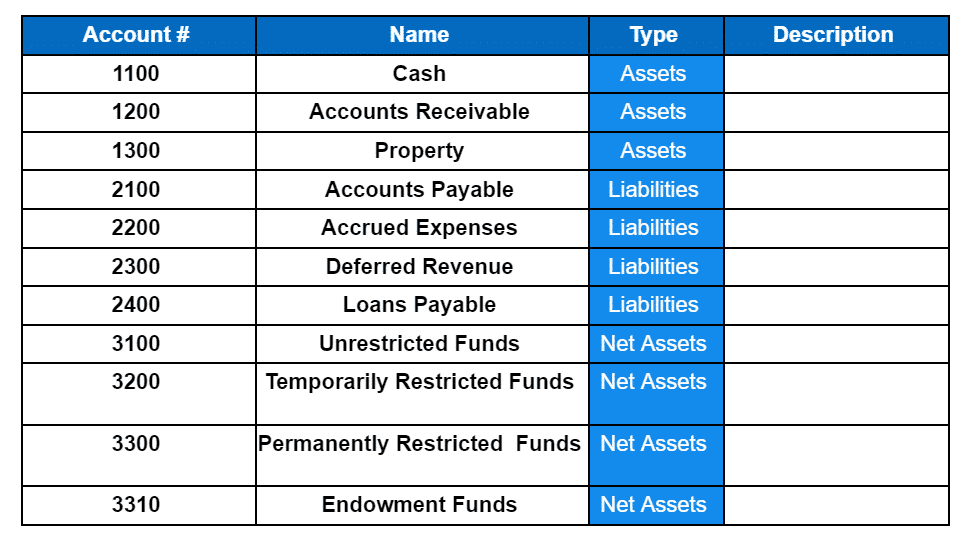

Chart Of Accounts Nonprofit - Liability account numbering usually begins with 2. Analyze your organization’s needs and objectives. Get all the details in this blog. Web the nonprofit chart of accounts is an invaluable organizational structure for the nonprofit, serving as the basis from which all other reports, including the statement of financial position, statement of activities, statement of functional expenses, and statement of cash flows, will be sourced. Web a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. Every nonprofit organization has a unique coa that depends on your specific programs, revenue sources, and activities. Web the nonprofit chart of accounts is a crucial tool, offering a structured method to keep track of financial transactions, including payroll taxes, ensuring efficient financial management, regulatory adherence, and accurate reporting. However, here is a sample nonprofit chart of accounts that you can use if you need a place to start. Web 3 steps for numbering a chart of accounts. Let’s dive in with an overview of what your nonprofit’s coa is and how it’s. These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). Web the chart of accounts lists all of the accounts and ledgers your nonprofit accountant consults to compile these statements and track all financial transactions. But why should it matter to your nonprofit, and how will you create. A chart of accounts (coa) is a list of general accounts where each is broken down into categories to help nonprofit leaders monitor the financial position of an organization. Web steps for nonprofits to implement a chart of accounts. What is a chart of accounts for nonprofit organizations? Structuring a chart of accounts for nonprofit organizations; Web what is a. A chart of accounts (coa) is a list of general accounts where each is broken down into categories to help nonprofit leaders monitor the financial position of an organization. However, here is a sample nonprofit chart of accounts that you can use if you need a place to start. Web what is a chart of accounts anyway? Web a nonprofit. What is a nonprofit chart of accounts? Chart just makes it sound fancy. Web in this guide, we’ll cover the basics of the nonprofit chart of accounts, including: Web a chart of accounts is a list of all accounts used in the general ledger by a nonprofit organization. The word chart just makes it sound fancy. Web a chart of accounts is a tool used by businesses and nonprofits to keep track of financial transactions, as shown in nonprofit financial statements. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. Your coa should align with the specific needs of the organization and reflect its unique financial. Structuring a chart of accounts for nonprofit organizations; Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep up with, especially if you don’t fully understand its usefulness.” visit the guide and example. Web what is a nonprofit chart of accounts? Web a chart of accounts is a tool used by. Web a chart of accounts is a systematic way to organize and track financial transactions using different “accounts”. It defines classes of items your accounting system will use to aggregate transactions into your organization’s financial reporting. Web what is a nonprofit chart of accounts? Web steps for nonprofits to implement a chart of accounts. Web what is a nonprofit chart. Web what is a chart of accounts anyway? You create this list to meet your organization’s unique needs. Web a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. It also considers the specific reporting requirements imposed by regulatory bodies or funders. Because the coa compiles so much information, this important. Nonprofit chart of accounts example; A chart of accounts (coa) is a list of general accounts where each is broken down into categories to help nonprofit leaders monitor the financial position of an organization. The chart of accounts for your organization lists all of your accounts. You create this list to meet your organization’s unique needs. The program offers basic. Web what is a chart of accounts anyway? Web what is a nonprofit chart of accounts? But the first two, number and name, determine the overall structure and organization of accounts and subaccounts. But why should it matter to your nonprofit, and how will you create and maintain one? Web a chart of accounts (coa) is a list of financial. Web a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. This will help you categorize and organize them effectively. Web the chart of accounts (coa) tracks your various ledgers and everything your nonprofit does financially. Every nonprofit organization has a unique coa that depends on your specific programs, revenue sources, and activities. Web what is a nonprofit chart of accounts? The chart of accounts is a foundational part of your financial management system. A chart of accounts (coa) is a list of financial accounts set up for accounting purposes. You create this list to meet your organization’s unique needs. Purpose of the nonprofit chart of accounts; It’s a series of line items, or accounts, that allows you to organize your accounting data. Longer numbers can certainly be used, but that requires more keystrokes and may be harder to remember. But why should it matter to your nonprofit, and how will you create and maintain one? Web the chart of accounts lists all of the accounts and ledgers your nonprofit accountant consults to compile these statements and track all financial transactions. Number, name, category type, and a short description. It defines classes of items your accounting system will use to aggregate transactions into your organization’s financial reporting. To number a chart of accounts, start by determining the types of accounts your nonprofit has.

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

sample nonprofit chart of accounts

Example Of Chart Of Accounts For Nonprofit

Nonprofit Accounting Software > QuickBooks® Enterprise Industry Solutions

Sample Nonprofit Chart Of Accounts Quickbooks

Nonprofit Chart Of Accounts Example Excel

Chart Of Accounts For Nonprofit Sample

Nonprofit Chart of Accounts How to Get Started + Example

The Beginner’s Guide to Nonprofit Chart of Accounts

These Line Items Pertain To Your Financial Position (Or Statement Of Financial Position) And To Your Financial Activities (Or Statement Of Activities).

The Word Chart Just Makes It Sound Fancy.

Web The Nonprofit Chart Of Accounts Is A Crucial Tool, Offering A Structured Method To Keep Track Of Financial Transactions, Including Payroll Taxes, Ensuring Efficient Financial Management, Regulatory Adherence, And Accurate Reporting.

A Chart Of Accounts (Coa) Is A List Of General Accounts Where Each Is Broken Down Into Categories To Help Nonprofit Leaders Monitor The Financial Position Of An Organization.

Related Post: