Bollinger Band Charts Free

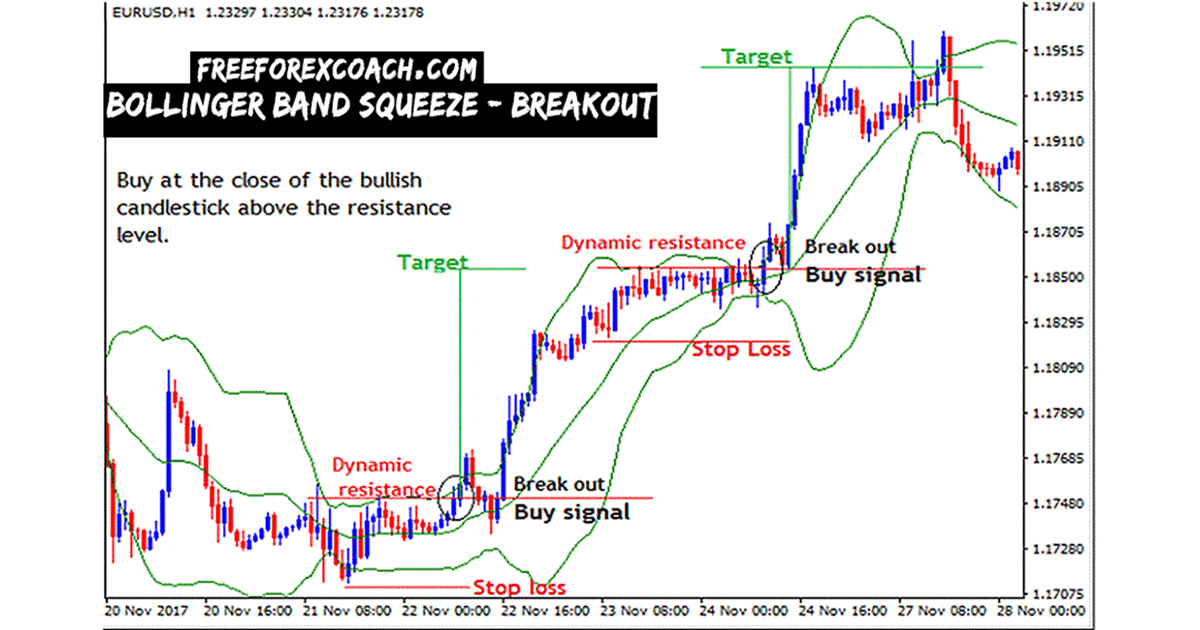

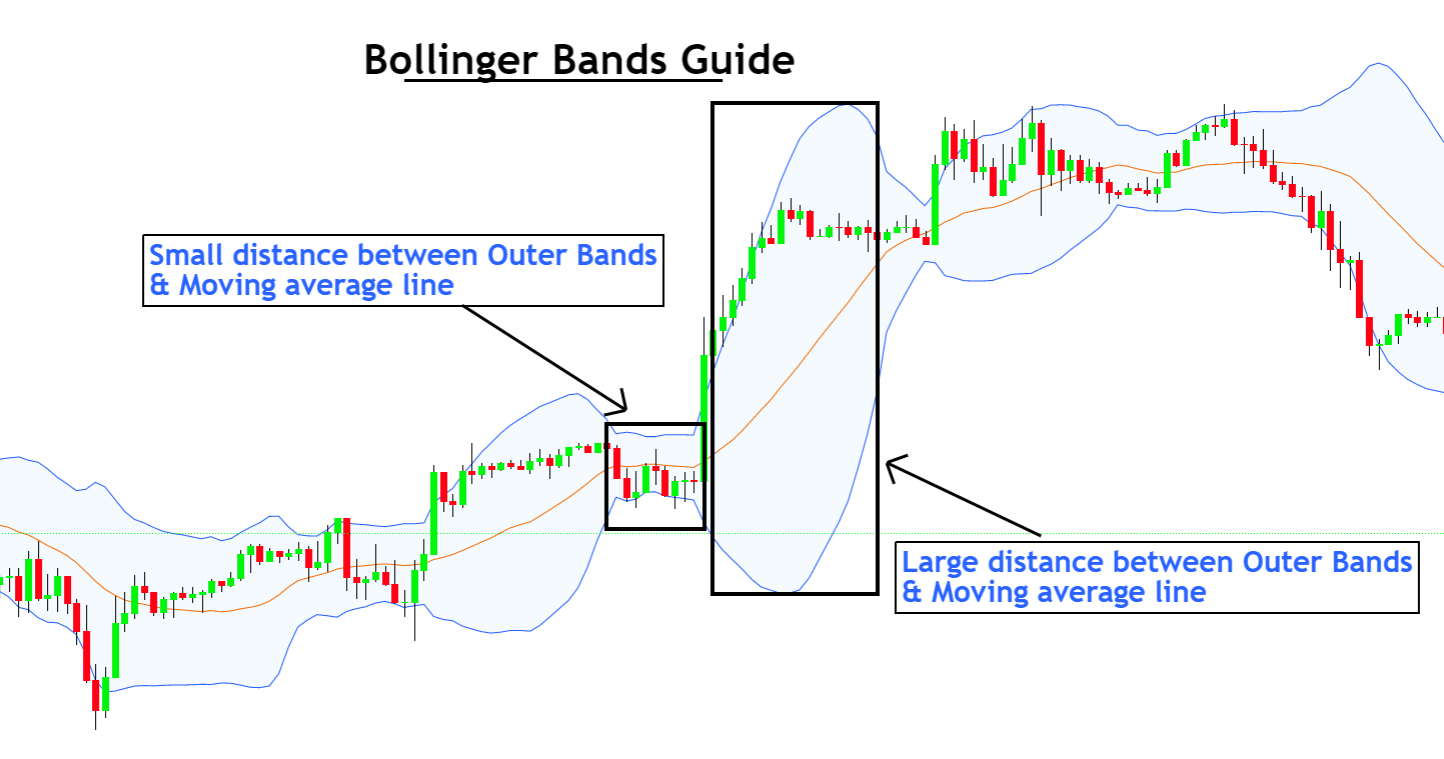

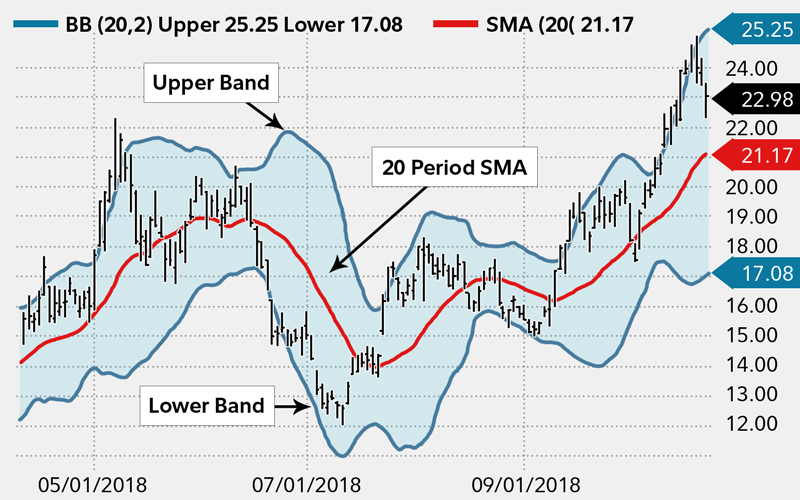

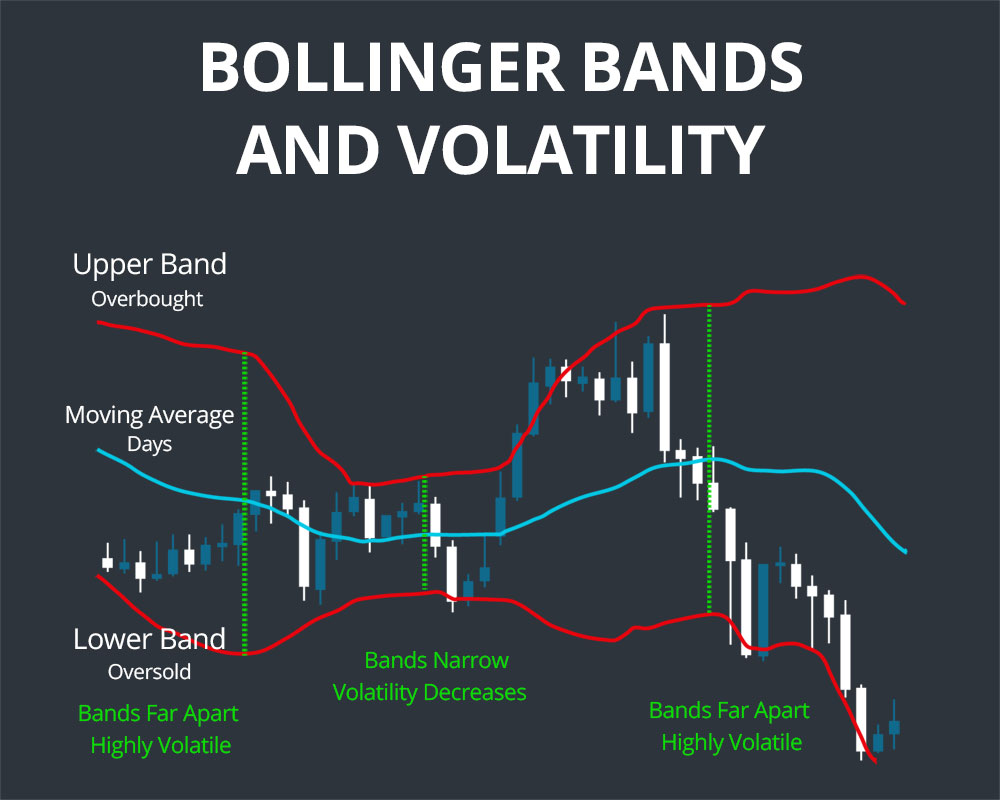

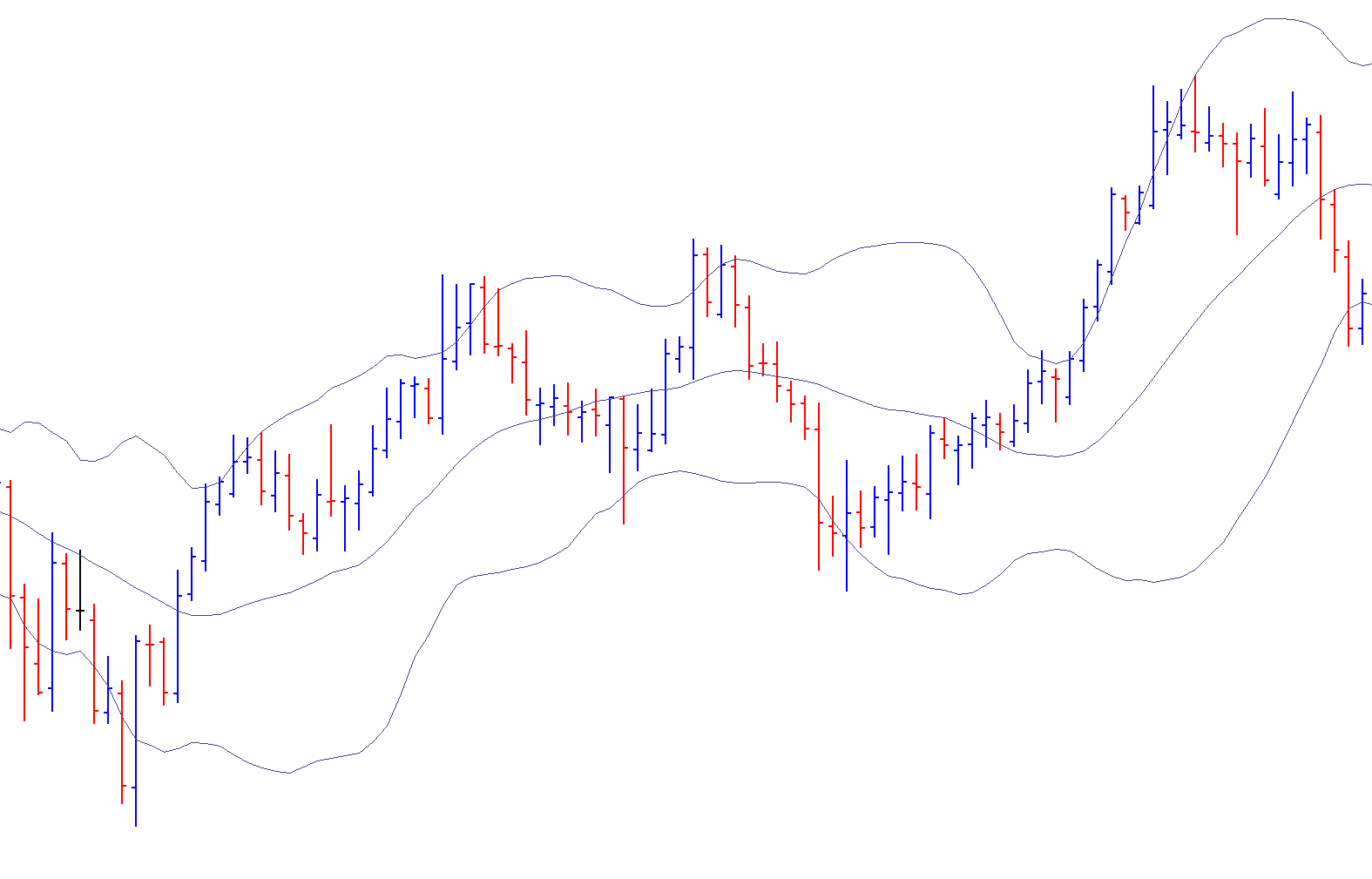

Bollinger Band Charts Free - These bands are composed of three lines: Building a trading strategy with bollinger bands®. The idea behind bollinger bands is the detection of price movements outside of a stock's typical fluctuations. The %b indicator measures a security's price in relation to the upper and lower bollinger bands. A simple moving average (the middle. Web bollinger bands ( / ˈbɒlɪndʒər /) are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by john bollinger in the 1980s. Web developed by john bollinger, bollinger bands® are volatility bands placed above and below a moving average. The middle line is just the simple moving average. Web free stock market info. Bollinger bands breakout technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web when the close is higher than the open the body is green. These bands are composed of three lines: You can use it to identify overbought or oversold conditions and gauge trend strength. Web a bollinger band squeeze is a condition that occurs when the bollinger bands narrow due to decreased volatility. The upper is calculated as sma +. Arrows plotted on the charts indicate a signal for. You can use it to identify overbought or oversold conditions and gauge trend strength. Web stock chart with bollinger bands indicator. The %b indicator measures a security's price in relation to the upper and lower bollinger bands. If you use it with other indicators, like the money. In addition, the signals for the bollinger bands methods are indicated on the charts: The upper is calculated as sma + (standard deviation * number of deviations). Web understanding bollinger bands in bitcoin trading. Web when the close is higher than the open the body is green. Web what is the %b indicator? When the close is lower than the open the body is red. Bollinger bands %b ^ bollinger bands squeeze ^ bollinger width. According to john bollinger, periods of low volatility are often followed by periods of high volatility. Bollinger bands are a technical analysis tool that was invented by john bollinger in the 1980s. Web what is the %b indicator? Therefore, a volatility contraction or narrowing of the. Bollinger bands have 3 lines. According to john bollinger, periods of low volatility are often followed by periods of high volatility. Average true range adjusted ^ average true range percent ^ awesome oscillator ^ bollinger bands®. Web bollinger bands is a technical analysis tool used to determine where prices are high and. Bollinger bands breakout technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The %b indicator measures a security's price in relation to the upper and lower bollinger bands. Bollinger bands are a technical analysis tool that was invented by john bollinger in the 1980s. The upper is. Bollinger bands have 3 lines. A simple moving average (the middle. These bands are composed of three lines: Bollinger bands use a moving average over period n plus/minus the standard deviation over. Stock exchange and supported by alpha vantage. Bollinger bands %b ^ bollinger bands squeeze ^ bollinger width. Web free stock market info. Stock exchange and supported by alpha vantage. The middle line is just the simple moving average. Learn how bollinger bands® can help you gauge trends, monitor for breakouts, and boost your technical analysis. If you use it with other indicators, like the money. Bollinger band is a technical analysis indicator designed to provide investors with insights to discover oversold and undersold assets. Bollinger bands %b ^ bollinger bands squeeze ^ bollinger width. You can use it to identify overbought or oversold conditions and gauge trend strength. Web bollinger bands are a technical indicator. Arrows plotted on the charts indicate a signal for. Building a trading strategy with bollinger bands®. This indicator looks like an envelope that forms an upper and lower band around the price. The %b indicator measures a security's price in relation to the upper and lower bollinger bands. Stock exchange and supported by alpha vantage. Average true range adjusted ^ average true range percent ^ awesome oscillator ^ bollinger bands®. Web bollinger bands is a technical analysis tool used to determine where prices are high and low relative to each other. When the close is lower than the open the body is red. Web a bollinger band squeeze is a condition that occurs when the bollinger bands narrow due to decreased volatility. Volatility is based on the standard deviation, which changes as volatility increases and decreases. The purpose of the bollinger is to provide a projected high and low price by the placement of bands on the. Web bollinger bands ( / ˈbɒlɪndʒər /) are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by john bollinger in the 1980s. In addition, the signals for the bollinger bands methods are indicated on the charts: Bollinger bands use a moving average over period n plus/minus the standard deviation over. They consist of a simple moving average (sma) as the center line and two standard deviation lines above and below, forming a. If you use it with other indicators, like the money. Stock exchange and supported by alpha vantage. The %b indicator measures a security's price in relation to the upper and lower bollinger bands. Therefore, a volatility contraction or narrowing of the. Bollinger bands are a technical analysis tool that was invented by john bollinger in the 1980s. Web when the close is higher than the open the body is green.

Bollinger Bands Strategy in Forex Trading Free Forex Coach

Bollinger Bands Explained with Formula And Strategy StockManiacs

The Ultimate Bollinger Bands Cheat Sheet ForexBee

How to use Bollinger Bands Fidelity

Bollinger Bands What You Need To Know To Change Your Trading

Bollinger Bands are used jointly with a moving average. But short term

Read more about bollinger band trading TechnicalAnalysisCharts in

Bollinger Bands Explained With Free PDF Download

![Bollinger Bands [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=technical_indicators:bollinger_bands:bb-acp.png)

Bollinger Bands [ChartSchool]

Bollinger Bands What They Are and How to Use Them Ticker Tape

This Indicator Looks Like An Envelope That Forms An Upper And Lower Band Around The Price.

They Are Used To Measure The Volatility Of A Financial Asset, Like Bitcoin, Over A Specified Period Of Time.

Building A Trading Strategy With Bollinger Bands®.

Bollinger Bands Is A Widely Used Technical Analysis Tool In Trading, Developed By John Bollinger In The 1980S.

Related Post: