Benner Cycle Chart

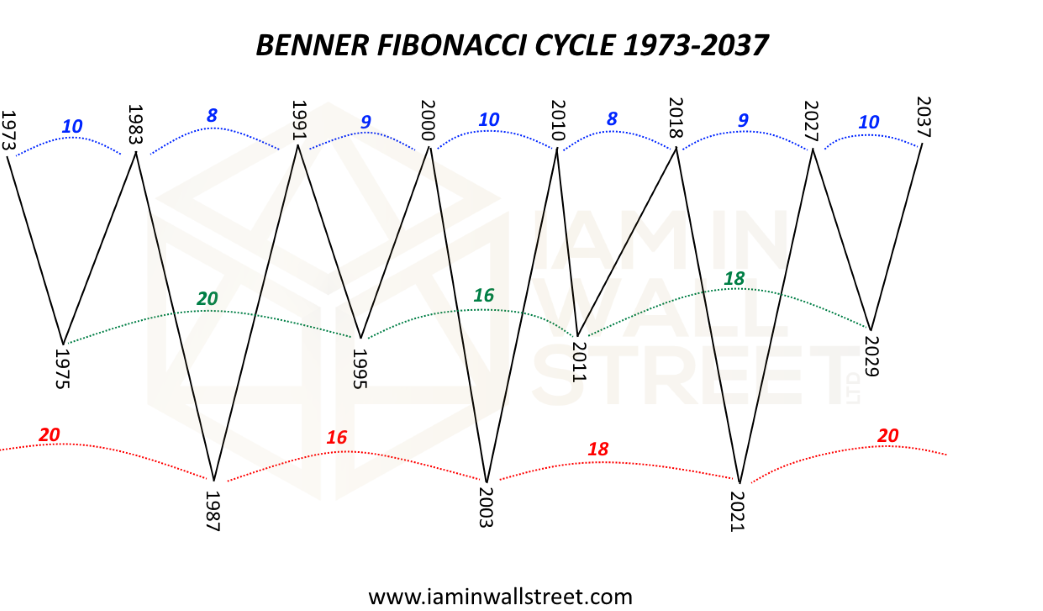

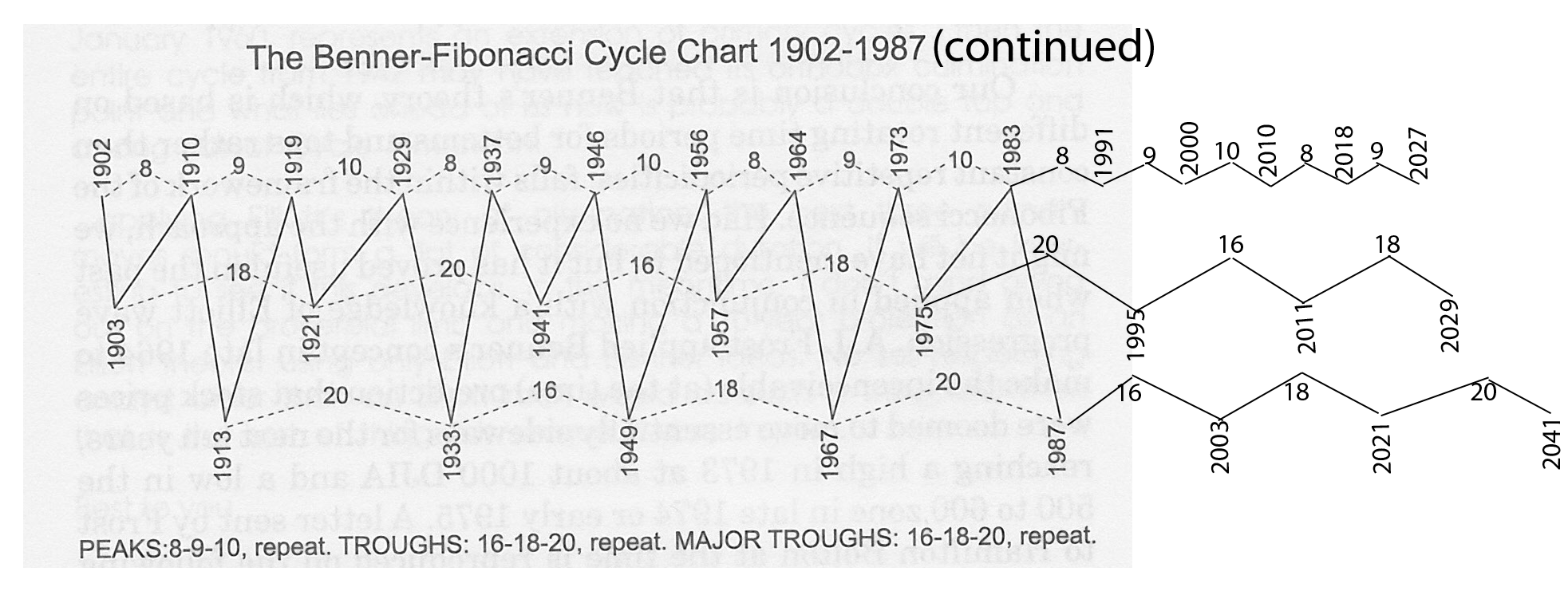

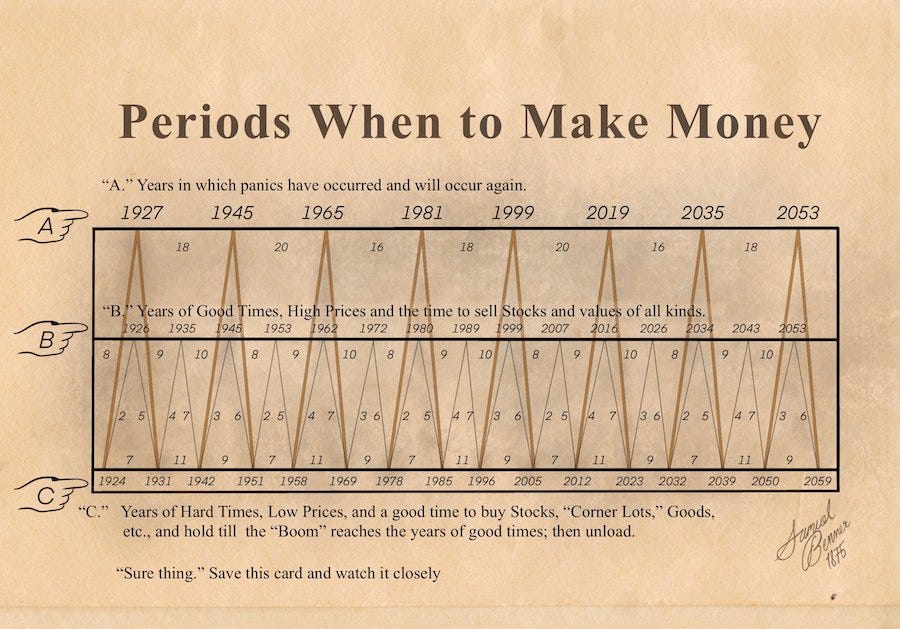

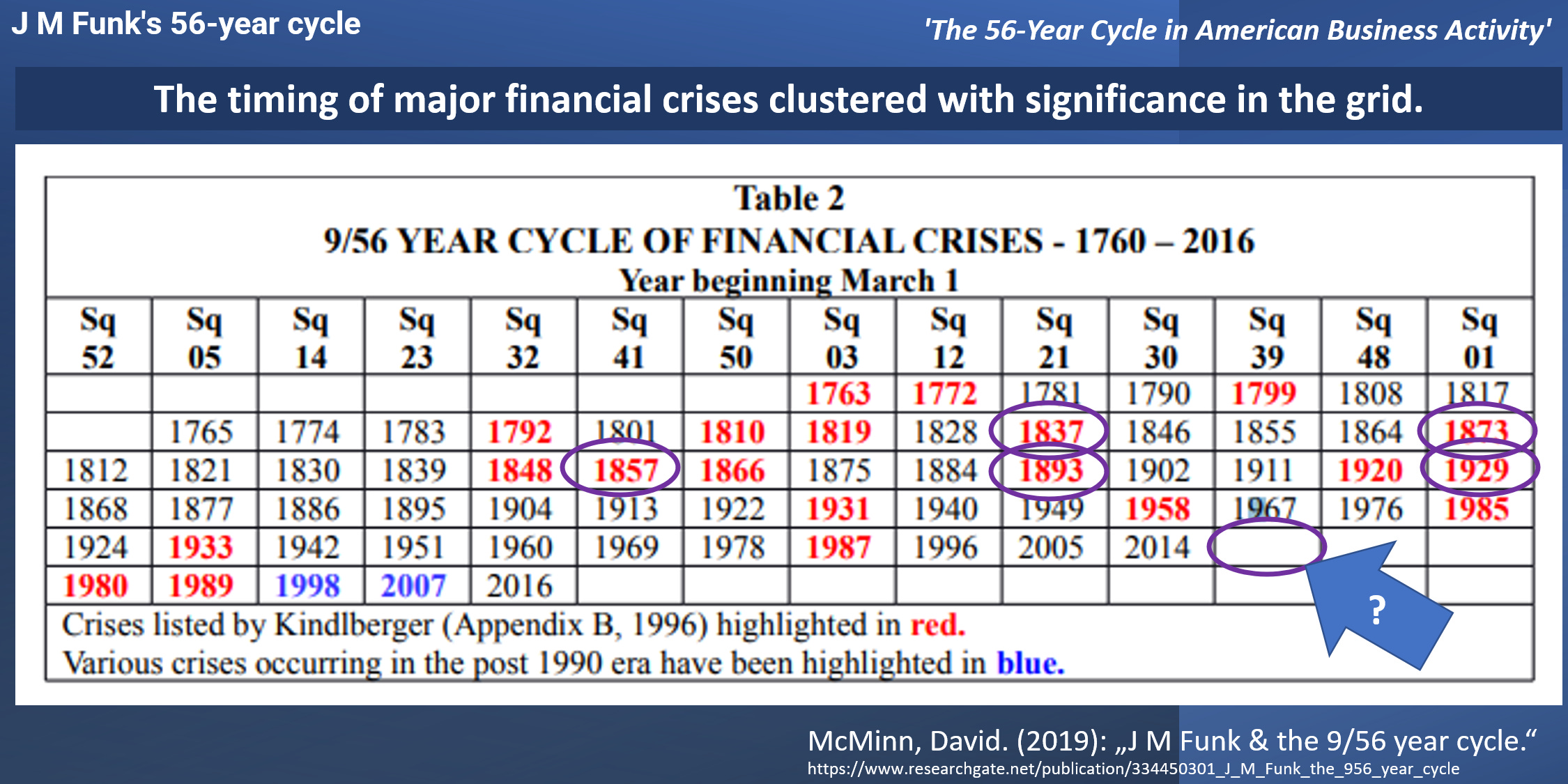

Benner Cycle Chart - See examples of stocks in the accumulation stage and how to apply technical indicators to identify opportunities. Web exploring the origins of the “ periods when to make money ” chart, also known as the benner cycle, historical records present a complex narrative. In part i, we examine the performance of the s&p 500 index during the major favorable and unfavorable periods in the past 100 years. The chart below was purportedly created by a man named samuel benner in 1875. Web stock market results within various favorable and unfavorable periods appear compelling. The a line represents years of market panics, which. The chart below was purportedly created by a man named samuel benner in 1875. The start of a market cycle See how accurate it is and how to use it for your own investing decisions. The chart below was purportedly created by samuel benner in 1875. The chart was originally published by ohioan farmer samuel benner in his 1884 book, benner's prophecies of future ups and downs in prices. See examples of stocks in the accumulation stage and how to apply technical indicators to identify opportunities. Web benner mentioned three commodity cycles: Panic years, good times, and hard times. The chart below was purportedly created by. It consists of three lines: The chart depicts the years of hard times (c), the years of good times (b), and the years of panic (a) in the stock markets. The chart below was purportedly created by samuel benner in 1875. Web learn about the benner cycle, a periodicity theory based on the 11, 27 and 56 year cycles in. However, george tritch, another 19th century forecaster, is believed to have extended the cycle all the way to 2059, and even annotated the chart with specific instructions on when to buy and sell stocks. The chart marks three phases of market cycles: Web the benner cycle, the fibonaccis & the number 56: The chart was originally published by ohioan farmer. Newspapers of the time reprinted his “surprisingly accurate”. The minor cycle (the light gray line) starts by rising from 1924 to 1926 (favorable), then declines from 1926 to 1931. It then rises for four years and declines for 7, then completes its pattern by increasing for three years, then falling for 6. It was an attempt to predict future cycles. Web the benner cycle, the fibonaccis & the number 56: It was an attempt to predict future cycles in the stock market. Web stock market results within various favorable and unfavorable periods appear compelling. Web the cycle he identified moves based on three time sequences: It consists of three lines: There isn’t another mention on the benner cycle chart until 2023, so we could keep grinding the market higher until it breaks, resulting in another market crash and “years of hard times” in the market. In parts i and ii, we examined market performance during favorable and unfavorable periods for the major and minor cycles in the benner cycle. The. See how accurate it is and how to use it for your own investing decisions. Newspapers of the time reprinted his “surprisingly accurate”. Web the three key cycles are presented in diagram 1 and consist of: Web benner cycle is a chart depicting market cycles between the years 1924 to 2059. The first diagram traced back to the late 1800s,. In part i, we examine the performance of the s&p 500 index during the major favorable and unfavorable periods in the past 100 years. Web now, the year is 2021, and on the benner cycle, we are just coming out of a panic cycle. See examples of stocks in the accumulation stage and how to apply technical indicators to identify. Web the three key cycles are presented in diagram 1 and consist of: Web benner's three cycles consisted of: Part iii focuses on periods when both major and minor cycles are favorable or unfavorable. Web learn about the benner cycle, a 19th century farmer's prediction of market trends based on human emotions. Web learn about the benner cycle, a periodicity. The first diagram traced back to the late 1800s, cites dual origins: In parts i and ii, we examined market performance during favorable and unfavorable periods for the major and minor cycles in the benner cycle. Web now, the year is 2021, and on the benner cycle, we are just coming out of a panic cycle. The chart marks three. Web the benner cycle is a chart depicting market cycles between the years 1924 to 2059. Web learn about the benner cycle, a periodicity theory based on the 11, 27 and 56 year cycles in commodity prices and market fluctuations. The chart below was purportedly created by a man named samuel benner in 1875. Web learn how to use the benner cycle, a cyclical pattern that repeats every four years, to invest in stocks and index funds. Panic years, good times, and hard times. Newspapers of the time reprinted his “surprisingly accurate”. On benner’s cycle chart, four main events create a full market cycle: It then rises for four years and declines for 7, then completes its pattern by increasing for three years, then falling for 6. Web the benner cycle is a model that benner developed to predict the ups and downs of the stock market. Web samuel benner came up with the chart in 1875 on a business card. Web learn about the benner cycle, a 19th century farmer's prediction of market trends based on human emotions. Web the cycle he identified moves based on three time sequences: Web the benner cycle, the fibonaccis & the number 56: The chart below was purportedly created by a man named samuel benner in 1875. There isn’t another mention on the benner cycle chart until 2023, so we could keep grinding the market higher until it breaks, resulting in another market crash and “years of hard times” in the market. It consists of three lines:

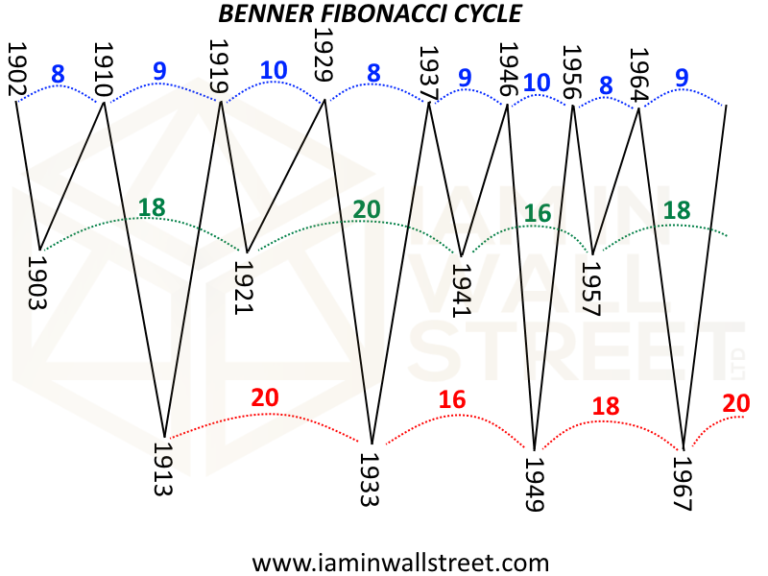

Do not the Benner Fibonacci Cycle I Am In Wall Street

Pattern of Financial Recessions Could Be Pointing to 2021 as the Next

The Benner Cycle Short Version Market Mondays w/ Ian Dunlap YouTube

Investment Chart Kondratiev Wave Analogy, Economics, Charts, Wave, Fear

Benner Cycle Anomaly Why 2023 May be the Year to Buy Stocks According

Looking at longterm cycle patterns, what might 2023 hold for equity

investing on the waves The Benner cycle

Do not the Benner Fibonacci Cycle I Am In Wall Street

Bitcoin Be LONG TERM GREEDY!! The 9 Year Benner Cycle Bull! for

Timing Market and Economic Cycle Phases by Thomas Mann All Things

Web Exploring The Origins Of The “ Periods When To Make Money ” Chart, Also Known As The Benner Cycle, Historical Records Present A Complex Narrative.

The Start Of A Market Cycle

Web Stock Market Results Within Various Favorable And Unfavorable Periods Appear Compelling.

The First Diagram Traced Back To The Late 1800S, Cites Dual Origins:

Related Post: