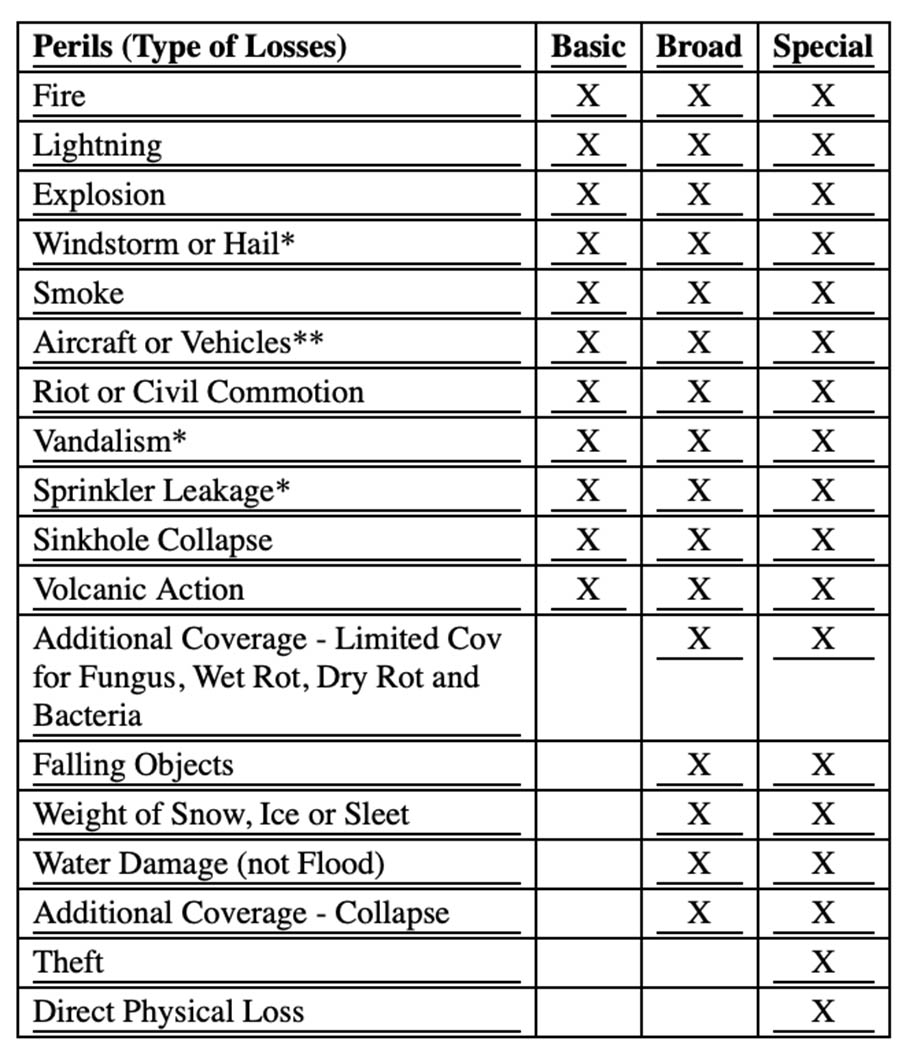

Basic Broad Special Causes Of Loss Chart

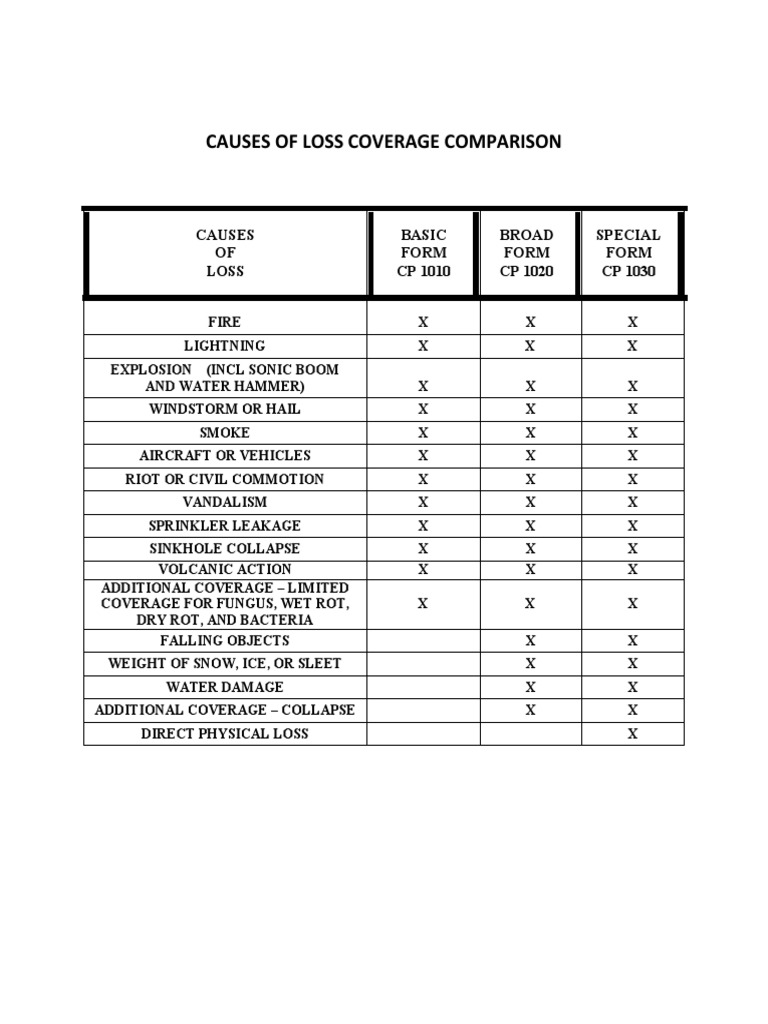

Basic Broad Special Causes Of Loss Chart - It is the silver package of the three forms and gives you the bare minimum for the. Web basic is the least inclusive of the three coverage forms because it covers only named perils. Web basic form is the most restrictive, while special offers the greater level of protection. Web if you’ve shopped for property insurance before, you may have noticed that some policies list covered losses as basic, while others specify broad or special. Each form provides coverage for different sets of perils, offering varying levels of protection to the. Basic, broad, special and earthquake. Web there are three main types of cause of loss forms: Web there are three causes of loss forms: Selecting the “basic” form of insurance coverage will only cover your property from named perils. Web causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. Web causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. The differences in the perils. The special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Web there are three main types of cause of loss forms: Web koverage insurance group was formed through. Web there are three causes of loss forms: Web basic is the least inclusive of the three coverage forms because it covers only named perils. Web in terms of property coverage, there are three causes of loss forms available for landlord insurance policies: Web basic form insurance coverage. Web causes of loss forms establish and define the causes of loss. The differences in the perils. Web basic is the least inclusive of the three coverage forms because it covers only named perils. Web causes of loss coverage comparison causes of loss basic broad special fire x x x lightning x x x explosion x x x windstorm or hail x x x smoke x x x aircraft or. The basic. Differentiate between the covered causes of loss forms: Web causes of loss coverage comparison causes of loss basic broad special fire x x x lightning x x x explosion x x x windstorm or hail x x x smoke x x x aircraft or. It is the silver package of the three forms and gives you the bare minimum for. Web the basic and broad causes of loss forms are named perils forms; Web as stated in the commercial lines manual (clm), rule 70.d.2., when rating a basic form policy, the amount of insurance and the coinsurance percentage must be the same for. Basic, broad, and special (or open). Web to make it easy to see the coverage differences, we’ve. The broad causes of loss form (cp 10 20) provides named perils coverage. Web causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. Basic, broad, and special (or open). Each form provides coverage for different sets of perils, offering varying levels of protection to the. Web if you’ve shopped for property. Each form provides coverage for different sets of perils, offering varying levels of protection to the. Web koverage insurance group was formed through the merger and acquisition of seven insurance agencies located throughout connecticut, south carolina, and florida who. Basic, broad, and special (or open). This simply means your property will only. Web basic is the least inclusive of the. Web basic form insurance coverage. Web basic cause of loss form covers fire lightning explosion windstorm and hail smoke aircraft or vehicles riot and civil commotion vandalism sprinkler leakage sinkhole. It is the silver package of the three forms and gives you the bare minimum for the. Web if you’ve shopped for property insurance before, you may have noticed that. Web basic is the least inclusive of the three coverage forms because it covers only named perils. Web to make it easy to see the coverage differences, we’ve included the below chart: Basic form covers these 11 “perils” or causes of loss: Web when property insurance is written on a broad form, you receive coverage for the 11 causes of. It is the silver package of the three forms and gives you the bare minimum for the. Web there are three main types of cause of loss forms: Web causes of loss forms establish and define the causes of loss (or perils) for which coverage is provided. Web basic cause of loss form covers fire lightning explosion windstorm and hail. The special causes of loss form (cp 10 30) provides what is referred to as all risks coverage: Differentiate between the covered causes of loss forms: Coverage for loss from any cause except those that. Web koverage insurance group was formed through the merger and acquisition of seven insurance agencies located throughout connecticut, south carolina, and florida who. Web as stated in the commercial lines manual (clm), rule 70.d.2., when rating a basic form policy, the amount of insurance and the coinsurance percentage must be the same for. Web basic cause of loss form covers fire lightning explosion windstorm and hail smoke aircraft or vehicles riot and civil commotion vandalism sprinkler leakage sinkhole. Web if you’ve shopped for property insurance before, you may have noticed that some policies list covered losses as basic, while others specify broad or special. It’s important to note that both basic and broad form coverage policies only cover a specific set of named perils. Web basic form insurance coverage. Basic, broad, and special (or open). Web when property insurance is written on a broad form, you receive coverage for the 11 causes of loss mentioned in the description of the basic form, with the addition of three. Web in terms of property coverage, there are three causes of loss forms available for landlord insurance policies: Web there are three causes of loss forms: Web basic is the least inclusive of the three coverage forms because it covers only named perils. The differences in the perils. Web causes of loss coverage comparison causes of loss basic broad special fire x x x lightning x x x explosion x x x windstorm or hail x x x smoke x x x aircraft or.

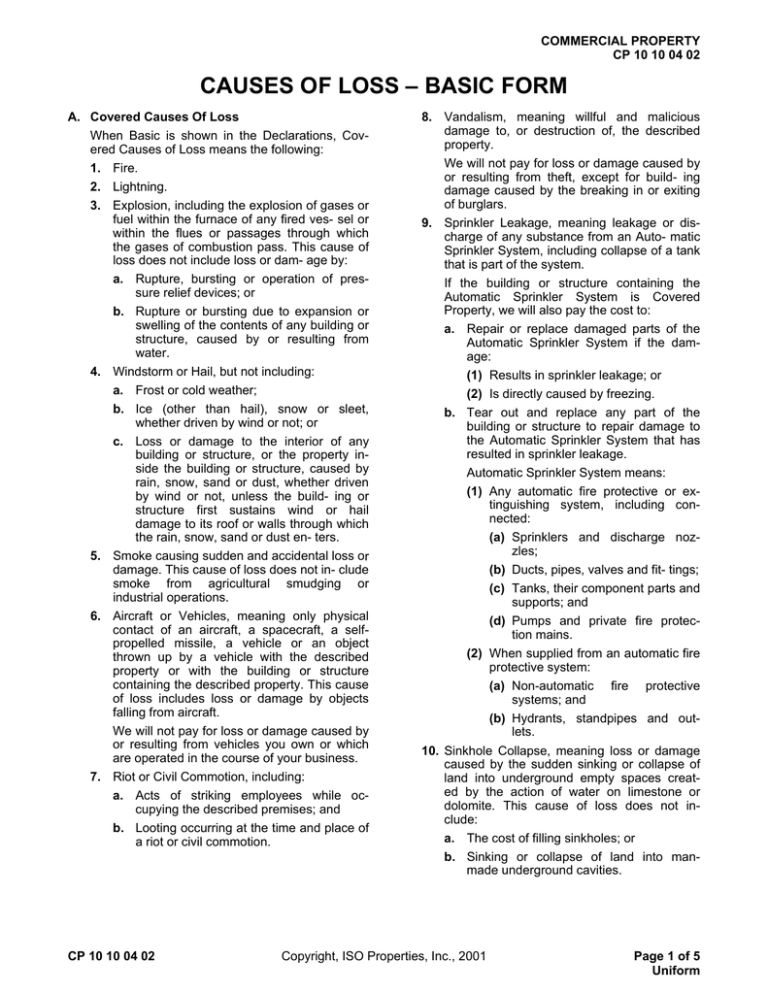

causes of loss basic form

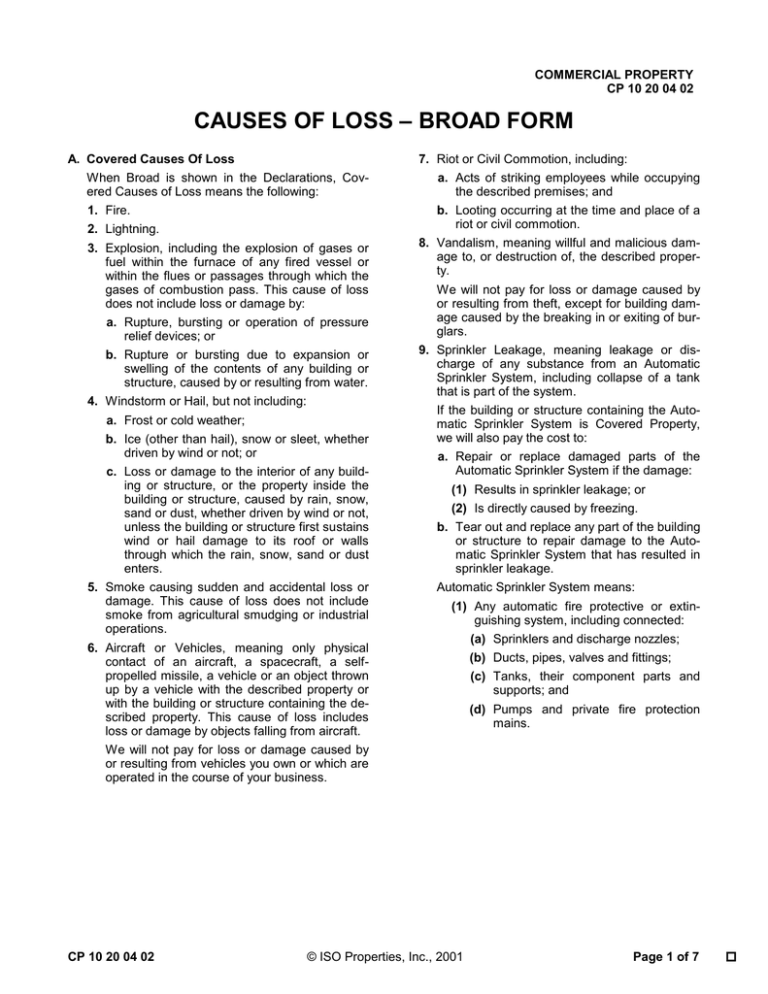

causes of loss broad form Midwest Security Insurance Services

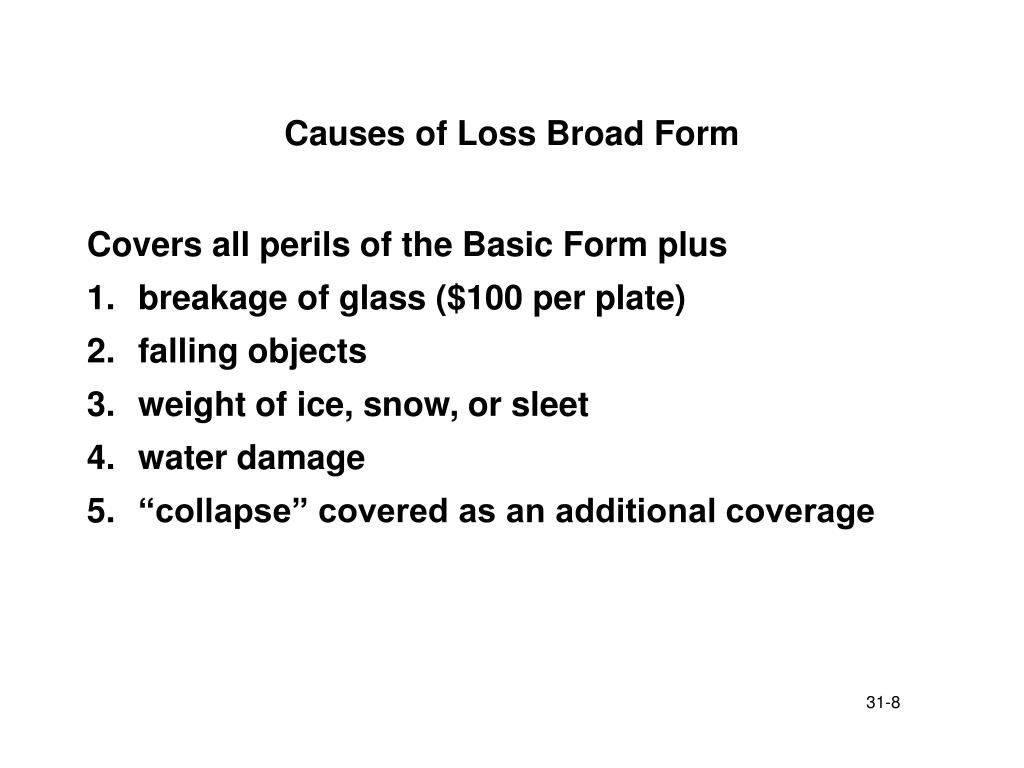

Comparing Coverage Options A Breakdown of Causes of Loss Coverages

Basic vs Special Form Coverage Insurance Resources

Causes Of Loss Forms Comparison Chart

Basic vs Special Form Insurance Coverage Resources Commercial

Causes Of Loss Forms Comparison Chart

Causes Of Loss Basic Form

Basic Broad And Special Perils Chart

Commercial Property Different Coverage Forms (Basic vs. Broad vs

The Broad Causes Of Loss Form (Cp 10 20) Provides Named Perils Coverage.

Web Basic Form Is The Most Restrictive, While Special Offers The Greater Level Of Protection.

They Provide Coverage For Loss From Only The Particular Causes That Are Listed In The Policy As Covered.

Each Form Provides Coverage For Different Sets Of Perils, Offering Varying Levels Of Protection To The.

Related Post: