Advance Decline Line Chart

Advance Decline Line Chart - Sie berechnet sich aus den aktien, die in einem bestimmten zeitraum (z. It is used in combination to identify changes across the two markets or to observe broad market. Web the advance/decline line (a/d) is a market indicator that traders use during stock technical analysis to estimate the breadth, or the overall strength or weakness of the stock market. This indicator currently suggests us stocks could keep rallying, with a caveat. It rises when advances exceed declines and falls when declines exceed advances. Nyse & nasdaq advance minus decline oscillator. The advance/decline index is a market breadth indicator. It represents the cumulative difference between the number of advancing and declining stocks within a. Click here for a live version of this chart. It can provide insight into the overall market’s direction and is often used to gauge broad market trend changes. This indicator is meant to observe nyse & nasdaq advance minus decline oscillator in one. Chartists can create the ad line by selecting “cumulative” as “type” under “chart attributes”. We explain its chart, formula, how to read it, examples, limitations, and differences with the arms index. Web what is the advance/decline index? It rises when advances exceed declines and falls. It compares the number of stocks that closed higher against the number of stocks that closed. This indicator currently suggests us stocks could keep rallying, with a caveat. It uses the number of advancing stocks vs. Net advances is positive when advances exceed declines. Web the advance/decline line (a/d) is a market indicator that traders use during stock technical analysis. When major indexes are rallying, a rising a/d line. Chartists can create the ad line by selecting “cumulative” as “type” under “chart attributes”. It rises when advances exceed declines and falls when declines exceed advances. Web the advance decline line tracks market uptrends and downtrends and is a staple for confirming price trends in major indices or spotting divergences that. Die veränderung des aktienniveaus wird dadurch ermittelt, dass die differenz des aktienindizes zum vortag berechnet wird. We explain its chart, formula, how to read it, examples, limitations, and differences with the arms index. Web what is the advance/decline index? Web what is the advance decline line? Click here for a live version of this chart. Web the advance/decline line (a/d) is a market indicator that traders use during stock technical analysis to estimate the breadth, or the overall strength or weakness of the stock market. Web the adl is represented by a line chart that plots the cumulative value of advancing minus declining stocks over time. Web the advance/decline (a/d) line is a breadth indicator. This indicator is meant to observe nyse & nasdaq advance minus decline oscillator in one. Chartists can create the ad line by selecting “cumulative” as “type” under “chart attributes”. The advance/decline index is a market breadth indicator. By looking at the slope of the chart, we can gain insights into the market’s breadth and overall strength. It compares the number. Web what is the advance decline line? Web the advance/decline line (ad line) is a breadth indicator which is calculated by taking the difference between the number of advancing and declining issues and adding the result to the previous value. Net advances is positive when advances exceed declines. Web what is the advance/decline index? Sie berechnet sich aus den aktien,. Chartists can create the ad line by selecting “cumulative” as “type” under “chart attributes”. Net advances is positive when advances exceed declines. This indicator currently suggests us stocks could keep rallying, with a caveat. Web what is the advance/decline index? Die veränderung des aktienniveaus wird dadurch ermittelt, dass die differenz des aktienindizes zum vortag berechnet wird. The a/d line monitors how many stocks are currently trading above or below the previous day’s close. Chartists can create the ad line by selecting “cumulative” as “type” under “chart attributes”. All_verklempt updated feb 23, 2023. An einem tag) gestiegen oder gefallen sind. Click here for a live version of this chart. We explain its chart, formula, how to read it, examples, limitations, and differences with the arms index. Click here for a live version of this chart. Web the advance/decline line (a/d) is a market indicator that traders use during stock technical analysis to estimate the breadth, or the overall strength or weakness of the stock market. Web advance decline chart. The indicator is cumulative, meaning that a positive value is added to the previous value, and a negative value is deducted from the previous value. It represents the cumulative difference between the number of advancing and declining stocks within a. Chartists can create the ad line by selecting “cumulative” as “type” under “chart attributes”. When major indexes are rallying, a rising a/d line. Die veränderung des aktienniveaus wird dadurch ermittelt, dass die differenz des aktienindizes zum vortag berechnet wird. Web the advance/decline (a/d) line is a breadth indicator used to show how many stocks are participating in a stock market rally or decline. Sie berechnet sich aus den aktien, die in einem bestimmten zeitraum (z. Web the advance decline line tracks market uptrends and downtrends and is a staple for confirming price trends in major indices or spotting divergences that may show a reversal. This indicator currently suggests us stocks could keep rallying, with a caveat. Net advances is positive when advances exceed declines. Net advancing volume is positive when advancing volume exceeds declining volume and negative when declining volume exceeds advancing volume. By looking at the slope of the chart, we can gain insights into the market’s breadth and overall strength. Web the adl is represented by a line chart that plots the cumulative value of advancing minus declining stocks over time. Breadth chart that measures advancing versus declining stocks on the nyse in real time. Web the advance/decline line (a/d) is a market indicator that traders use during stock technical analysis to estimate the breadth, or the overall strength or weakness of the stock market. Web die advance decline line repräsentiert eine chartlinie auf dem aktienmarkt.

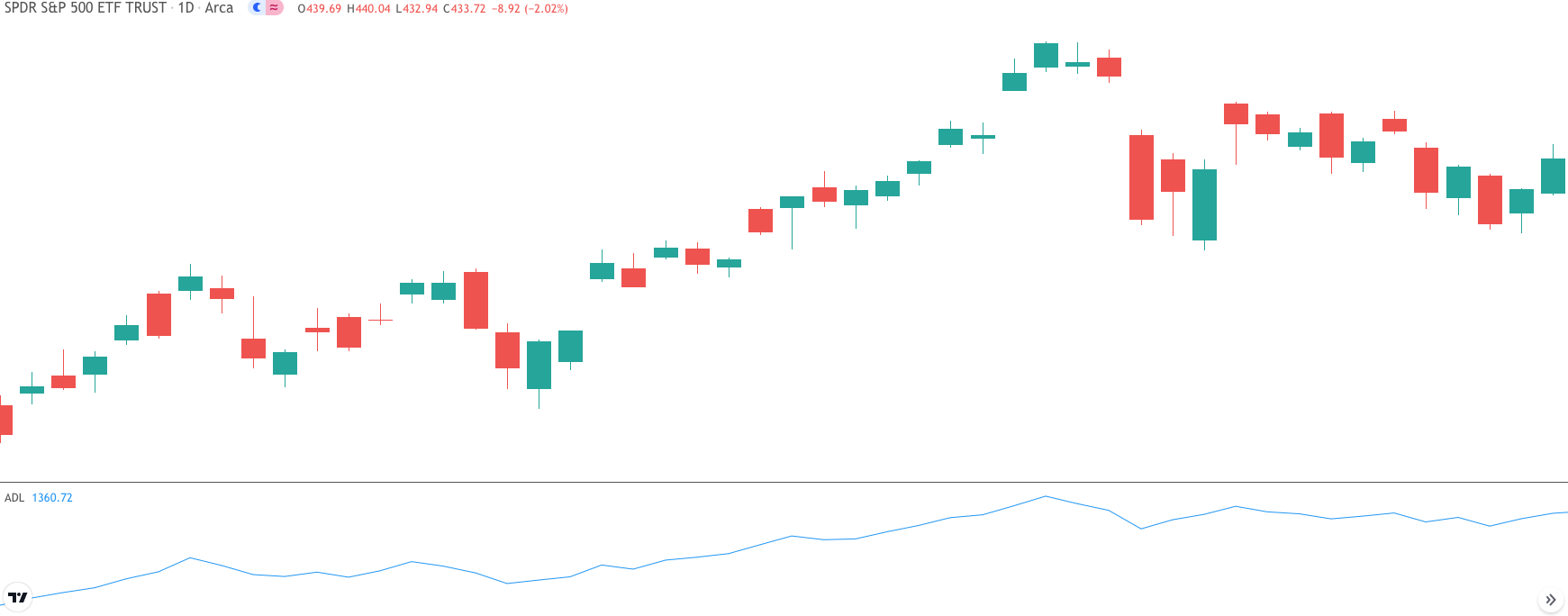

Analyzing Market Breadth With The Advance Decline Line Forex Training

![AdvanceDecline Line [ChartSchool]](https://school.stockcharts.com/lib/exe/fetch.php?media=market_indicators:ad_line:adl-01-nyexamp.png)

AdvanceDecline Line [ChartSchool]

Advance Decline Charts

Breadth Indicators

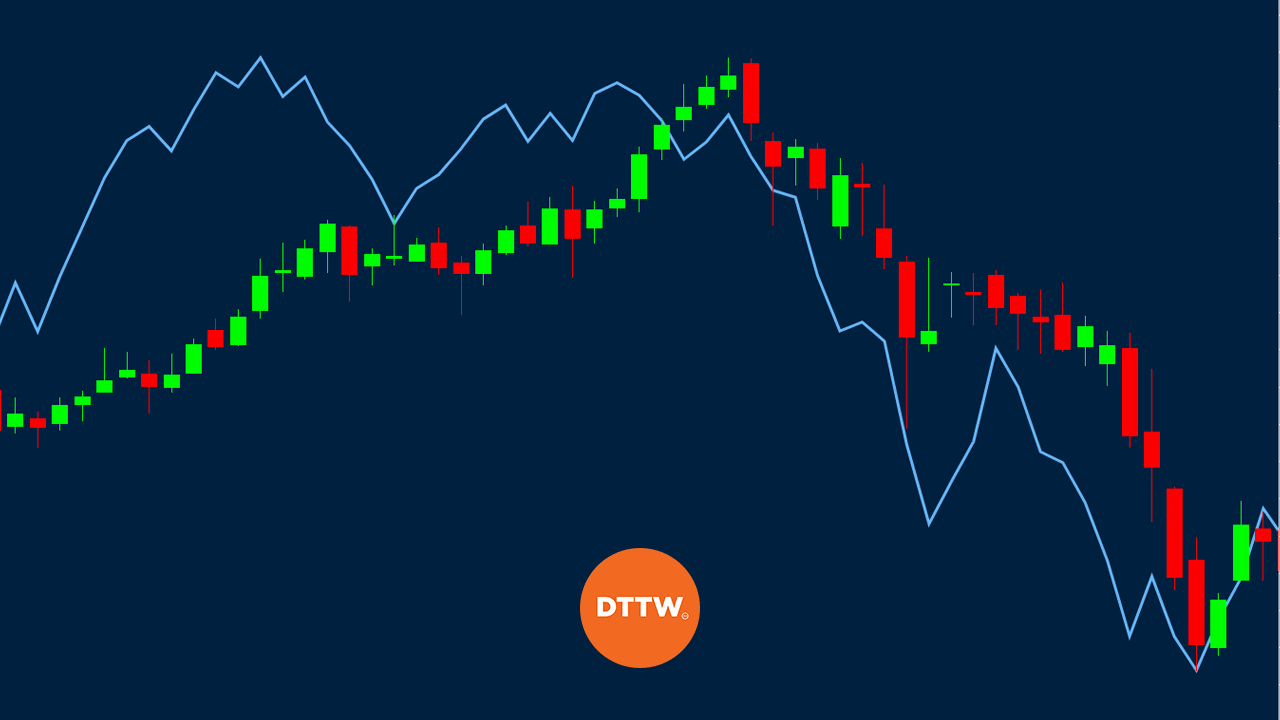

How to Trade Indexes with the Advance Decline Line (ADL) DTTW™

Taking Advance/Decline Line A Step Further All Star Charts

Advance Decline Line (ADL) Forex Strategy

Advance Decline Indicator Calculation & Usage StockManiacs

Advance Decline Charts

Technical Analysis 101 The Advance/Decline Line Potomac

Nyse & Nasdaq Advance Minus Decline Oscillator.

All_Verklempt Updated Feb 23, 2023.

It Rises When Advances Exceed Declines And Falls When Declines Exceed Advances.

Web What Is The Advance Decline Line?

Related Post: