940 Printable Form

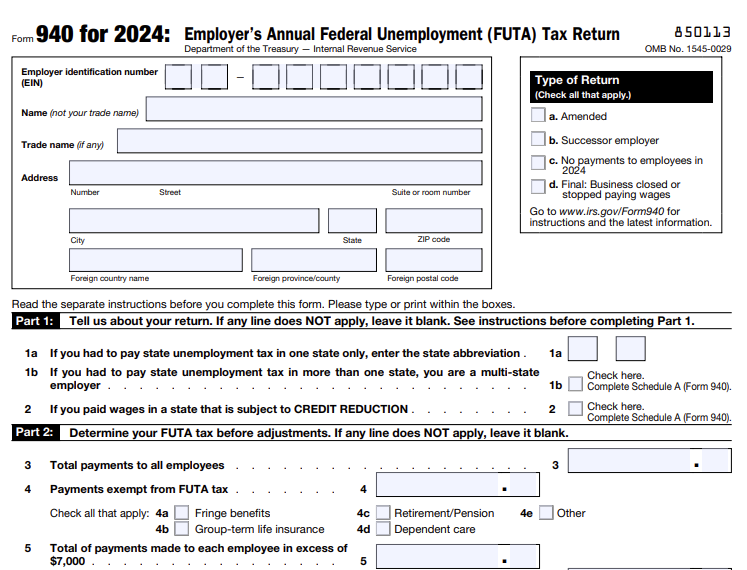

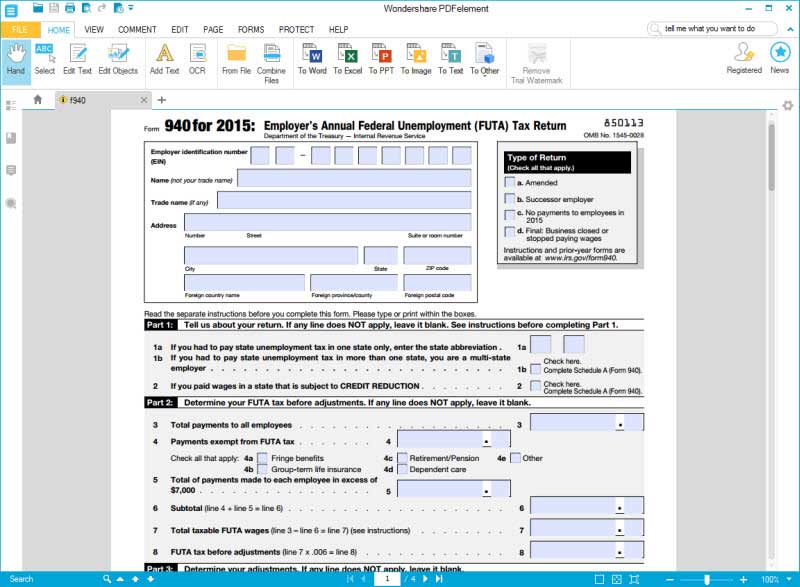

940 Printable Form - Web we last updated the employer's annual federal unemployment (futa) tax return in january 2024, so this is the latest version of form 940, fully updated for tax year 2023. Web irs form 940 is the employer’s annual federal unemployment tax return, filed separately from the form 941 employer’s quarterly tax returns. Form 940 is an internal revenue service (irs) document that lets employers report any federal unemployment tax act (futa) tax payments they’ve made over the calendar year. Web form 940 instructions. Irs releases form 940 unemployment return for 2021. We are committed to sharing unbiased reviews. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Some of the links on our site are from our partners who compensate us. Above is a fillable pdf version of form 940 that you can print or download. Web what is form 940? Web what is irs form 940? The deadline for filing the form is jan. Futa taxes are used to fund unemployment benefits for people who are laid off or lose their jobs through no fault of their own. Here’s a quick tl;dr on the futa tax: Web form 940 for 2022: It's used to figure the employer's federal unemployment tax based on the business's annual payroll. Irs releases form 940 unemployment return for 2021. Some of the links on our site are from our partners who compensate us. Web we last updated the employer's annual federal unemployment (futa) tax return in january 2024, so this is the latest version of form. Form 940 is an internal revenue service (irs) document that lets employers report any federal unemployment tax act (futa) tax payments they’ve made over the calendar year. Employer’s annual federal unemployment (futa) tax return 850113 department of the treasury — internal revenue service omb no. Written by sara hostelley | reviewed by brooke davis. And now, here’s how to fill. What is the futa tax? Some of the links on our site are from our partners who compensate us. You must file a 940 tax form if either of the following is true: Web updated march 06, 2024. Irs releases form 940 unemployment return for 2021. It's used to figure the employer's federal unemployment tax based on the business's annual payroll. Irs releases form 940 unemployment return for 2021. Form 940 is an annual tax form that documents your company’s contributions to federal unemployment taxes. You can print other federal tax forms here. The deadline for filing the form is jan. Here’s a quick tl;dr on the futa tax: Form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. You paid wages of at least $1,500 to any employee during the standard calendar year. We are committed to sharing unbiased reviews. This form is distinct from other tax forms because it. The deadline for filing the form is jan. You must file a 940 tax form if either of the following is true: December 6, 2021, 1:55 pm pst. What is the futa tax? We are committed to sharing unbiased reviews. Web form 940 for 2022: Here’s a quick tl;dr on the futa tax: Web we last updated the employer's annual federal unemployment (futa) tax return in january 2024, so this is the latest version of form 940, fully updated for tax year 2023. Employers must submit the form to the irs by january 31 of each year if they qualify.. Form 940 is an annual tax form that documents your company’s contributions to federal unemployment taxes. Form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax liability. Employers must submit the form to the irs by january 31 of each year if they qualify. You must file a 940. Form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. Employer’s annual federal unemployment (futa) tax return 850113 department of the treasury — internal revenue service omb no. Some of the links on our site are from our partners who compensate us. This form is distinct from other tax forms. Web we last updated the employer's annual federal unemployment (futa) tax return in january 2024, so this is the latest version of form 940, fully updated for tax year 2023. Web what is irs form 940? The deadline for filing the form is jan. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Futa taxes are used to fund unemployment benefits for people who are laid off or lose their jobs through no fault of their own. Form 940 is an irs document filed by employers once a year to report their federal unemployment tax act (futa) tax liability. Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Web form 940, employer’s annual federal unemployment (futa) tax return, is a form employers file with the irs to report their yearly futa tax liability. You paid wages of at least $1,500 to any employee during the standard calendar year. We are committed to sharing unbiased reviews. Irs form 940 is an essential document for us employers, specifically for reporting annual federal unemployment tax act (futa) taxes. Employer’s annual federal unemployment (futa) tax return 850113 department of the treasury — internal revenue service omb no. Irs releases form 940 unemployment return for 2021. This form is distinct from other tax forms because it focuses solely on unemployment taxes. Web updated march 06, 2024. What is the futa tax?

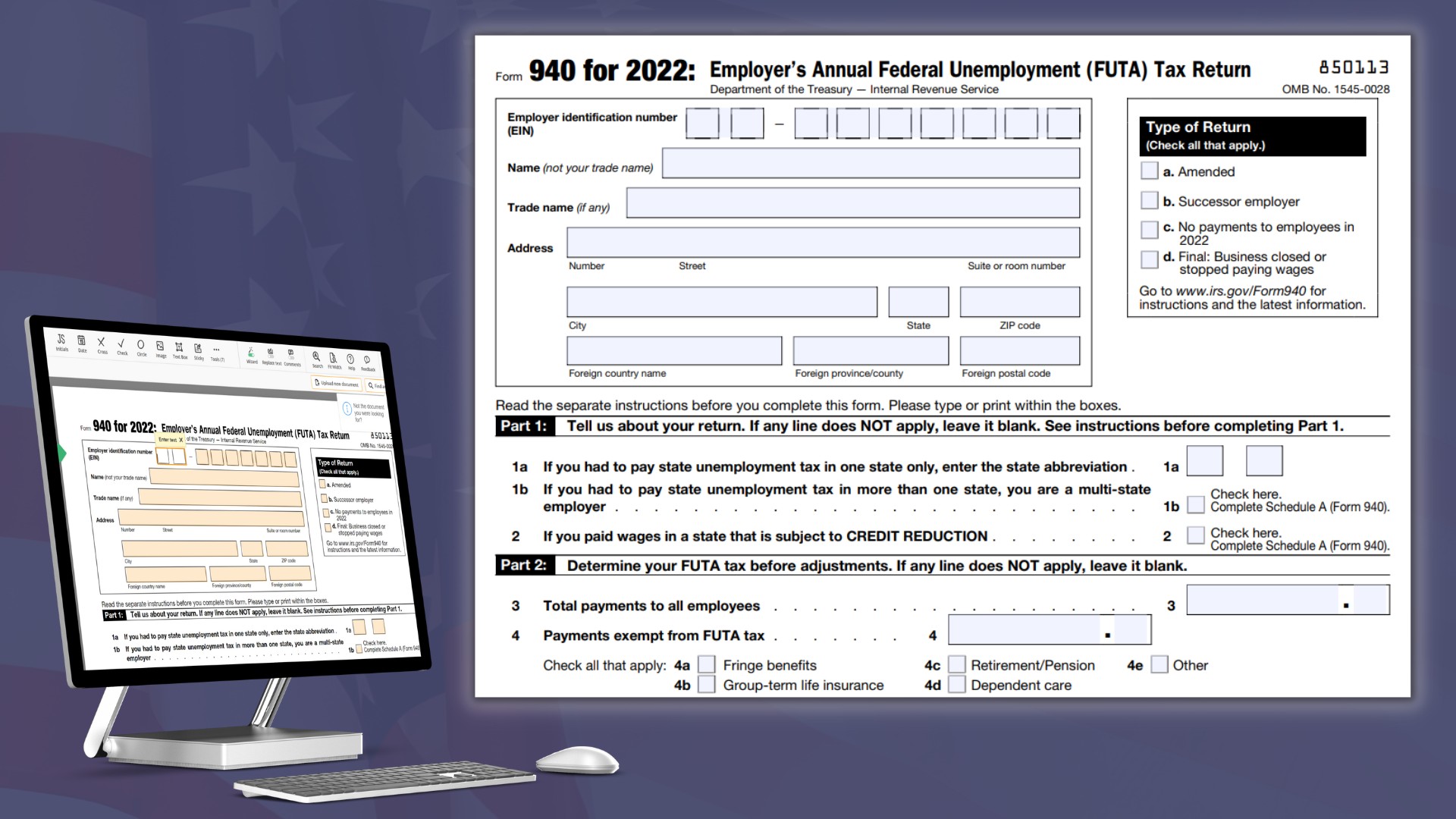

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Federal 940 Tax Form for 2022 > IRS Form 940 Printable & Fillable PDF

Fill Free fillable form 940 for 2018 employer's annual federal

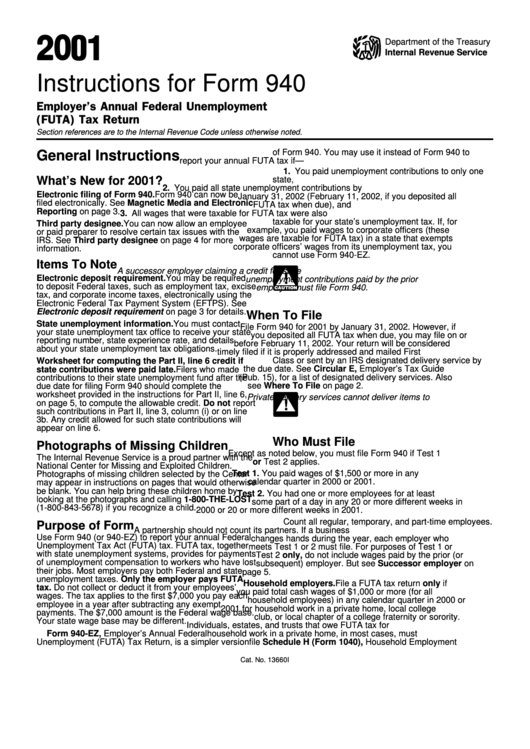

Instructions For Form 940 Employer'S Annual Federal Unemployment

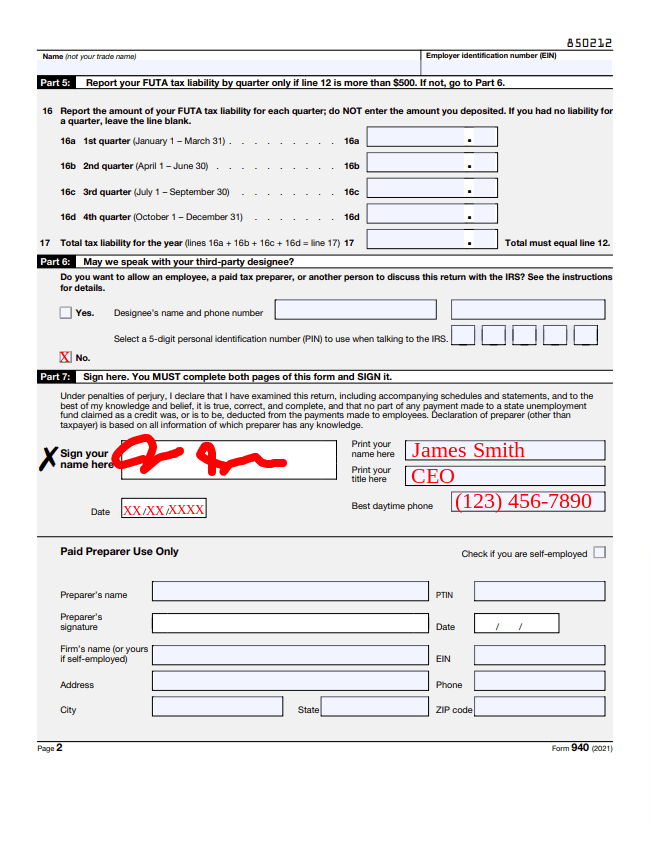

How to Fill Out Form 940 Instructions, Example, & More

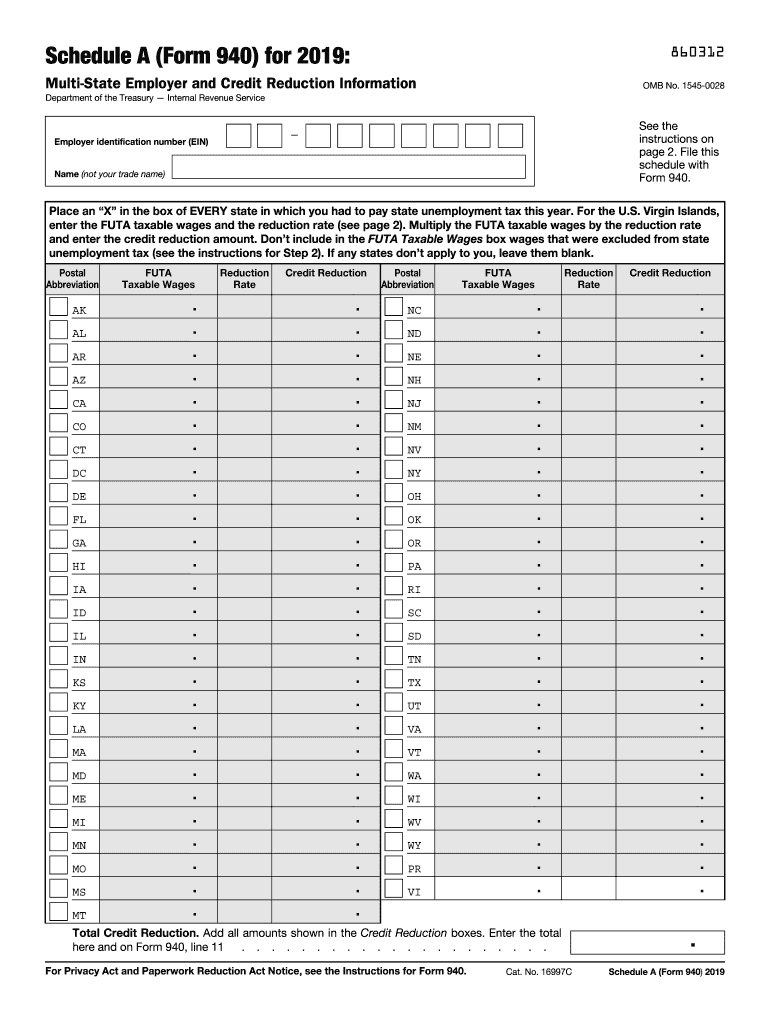

2019 Form IRS 940 Schedule A Fill Online, Printable, Fillable, Blank

Form 940 Instructions StepbyStep Guide Fundera

EFile Form 940 for 2023 tax year File IRS Form 940 Online

IRS Form 940 Filling Instructions to Save Your Time

Fill Free fillable form 940 for 2018 employer's annual federal

Form 940 Is An Annual Tax Form That Documents Your Company’s Contributions To Federal Unemployment Taxes.

Written By Sara Hostelley | Reviewed By Brooke Davis.

Here’s A Quick Tl;Dr On The Futa Tax:

Unlike Other Federal Payroll Taxes — Such As Medicare And Social Security — Futa Taxes Are Only Paid By The Employer And Not Deducted From Employees’ Wages.

Related Post: