2290 Fee Chart

2290 Fee Chart - A vehicle having a registered gross vehicle weight of 55,000 lbs pays $100 using form 2290. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Web to file a form 2290, you will need to provide the following information: Web discover all the essential information about the irs heavy vehicle use tax (hvut) form 2290, including filing requirements, deadlines, penalties, and faqs. Don’t use this revision if you need to file a return for a tax period that began on. The federal heavy vehicle use tax (hvut) is required and administered by the internal revenue service (irs). Form 8849 (sch.6 other claims) $ 19.95. Web yes, eform2290’s hvut tax calculator lets you calculate your 2290 online without any cost. Free form 2290 tax calculator from expresstrucktax, an irs. It is a fee assessed annually on heavy vehicles. Web heavy highway vehicle use tax return. Attach both copies of schedule 1 to this return. Form 2290 amendment (taxable gross weight increase + mileage exceeded) $ 19.95. Gvw, the fee for a 2290 is $550 a. Irs form 2290 highway use tax period starts from july 1st of each year and lasts till june 30th of the following year. Prepay, postpaid, and pay as you go models available for tax professionals. Web yes, eform2290’s hvut tax calculator lets you calculate your 2290 online without any cost. Web this july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. The current period begins july 1, 2023, and ends june 30,. Web. Web this july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. If you are reporting 25 or more taxable heavy highway motor vehicles for any taxable period, you. The current period begins july 1, 2023, and ends june 30,. What is the usual form 2290 tax period? Gvw, the fee. It calculates your 2290, considering factors such as taxable gross weight, first used. Irs form 2290 highway use tax period starts from july 1st of each year and lasts till june 30th of the following year. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The irs. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. It is a fee assessed annually on heavy vehicles. Web simply enter your vehicle weight and use type, and our app will immediately calculate your 2290 tax amount. Form 2290 amendment (taxable gross weight increase + mileage exceeded). Gvw, the fee for a 2290 is $550 a. Attach both copies of schedule 1 to this return. The federal heavy vehicle use tax (hvut) is required and administered by the internal revenue service (irs). Web what is the cost to file form 2290? Irs form 2290 highway use tax period starts from july 1st of each year and lasts. If you are reporting 25 or more taxable heavy highway motor vehicles for any taxable period, you. The irs requires a form 2290 (heavy highway vehicle use tax return) for all heavy vehicles operating on us public highways. Free form 2290 tax calculator from expresstrucktax, an irs. Don’t use this revision if you need to file a return for a. Web simply enter your vehicle weight and use type, and our app will immediately calculate your 2290 tax amount. Don’t use this revision if you need to file a return for a tax period that began on. Web this july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. At the. Web for vehicles purchased from a seller who has paid the tax for the current period: Don’t use this revision if you need to file a return for a tax period that began on. The irs requires a form 2290 (heavy highway vehicle use tax return) for all heavy vehicles operating on us public highways. The heavy highway vehicle use. Web simply enter your vehicle weight and use type, and our app will immediately calculate your 2290 tax amount. Web the fee you pay for the 2290 depends on the gvw of the registered vehicles that are required to file. Web this july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30,. Gvw, the fee for a 2290 is $550 a. Web discover all the essential information about the irs heavy vehicle use tax (hvut) form 2290, including filing requirements, deadlines, penalties, and faqs. The heavy highway vehicle use tax has several names including federal highway use tax, fhut, 2290, or even. If you are reporting 25 or more taxable heavy highway motor vehicles for any taxable period, you. Attach both copies of schedule 1 to this return. For the period july 1, 2023, through june 30, 2024. Don’t use this revision if you need to file a return for a tax period that began on. The irs requires a form 2290 (heavy highway vehicle use tax return) for all heavy vehicles operating on us public highways. Web the fee you pay for the 2290 depends on the gvw of the registered vehicles that are required to file. If a vehicle is purchased on or after july 1, 2023, but before june 1, 2024, and the buyer's first use. Prepay, postpaid, and pay as you go models available for tax professionals. Free form 2290 tax calculator from expresstrucktax, an irs. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Form 8849 (sch.6 other claims) $ 19.95. Irs form 2290 highway use tax period starts from july 1st of each year and lasts till june 30th of the following year. Web to file a form 2290, you will need to provide the following information:Form 2290 Instructions In Normal People Language

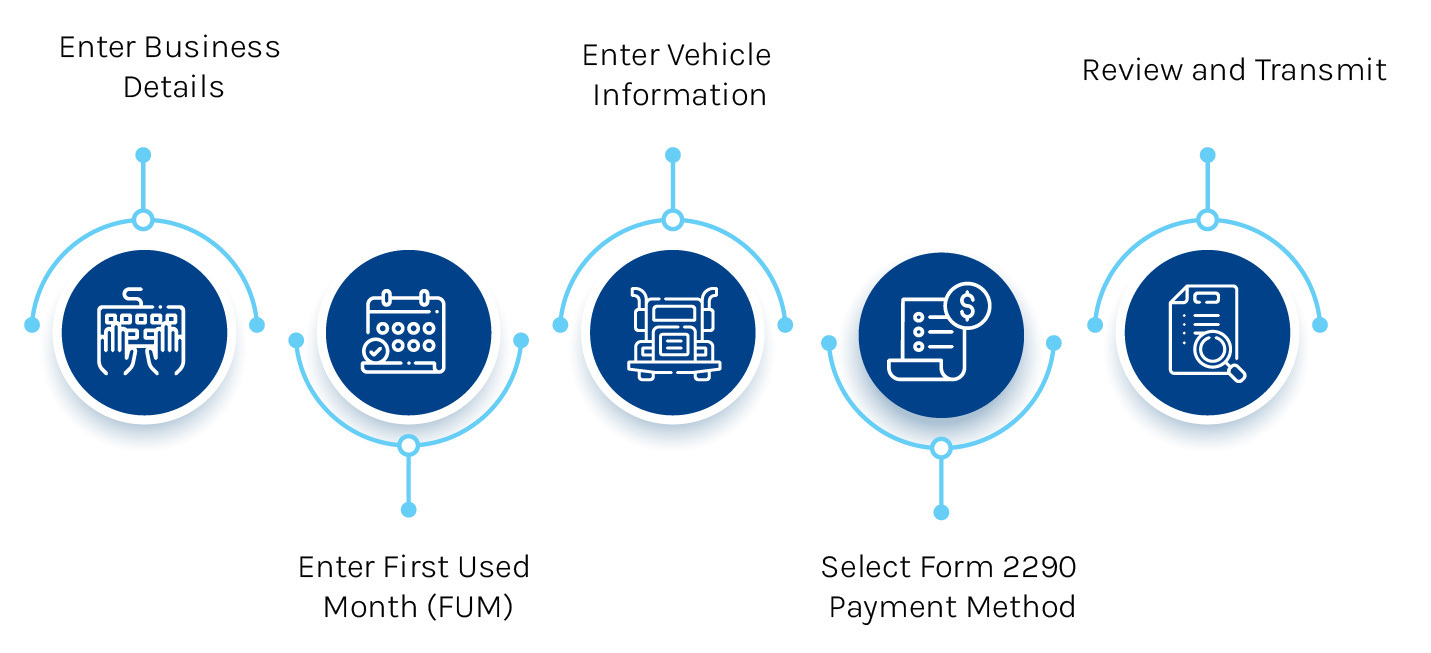

Why E File Form 2290 Tax Easy as 123!

IRS Form 2290 Fill it Without Stress

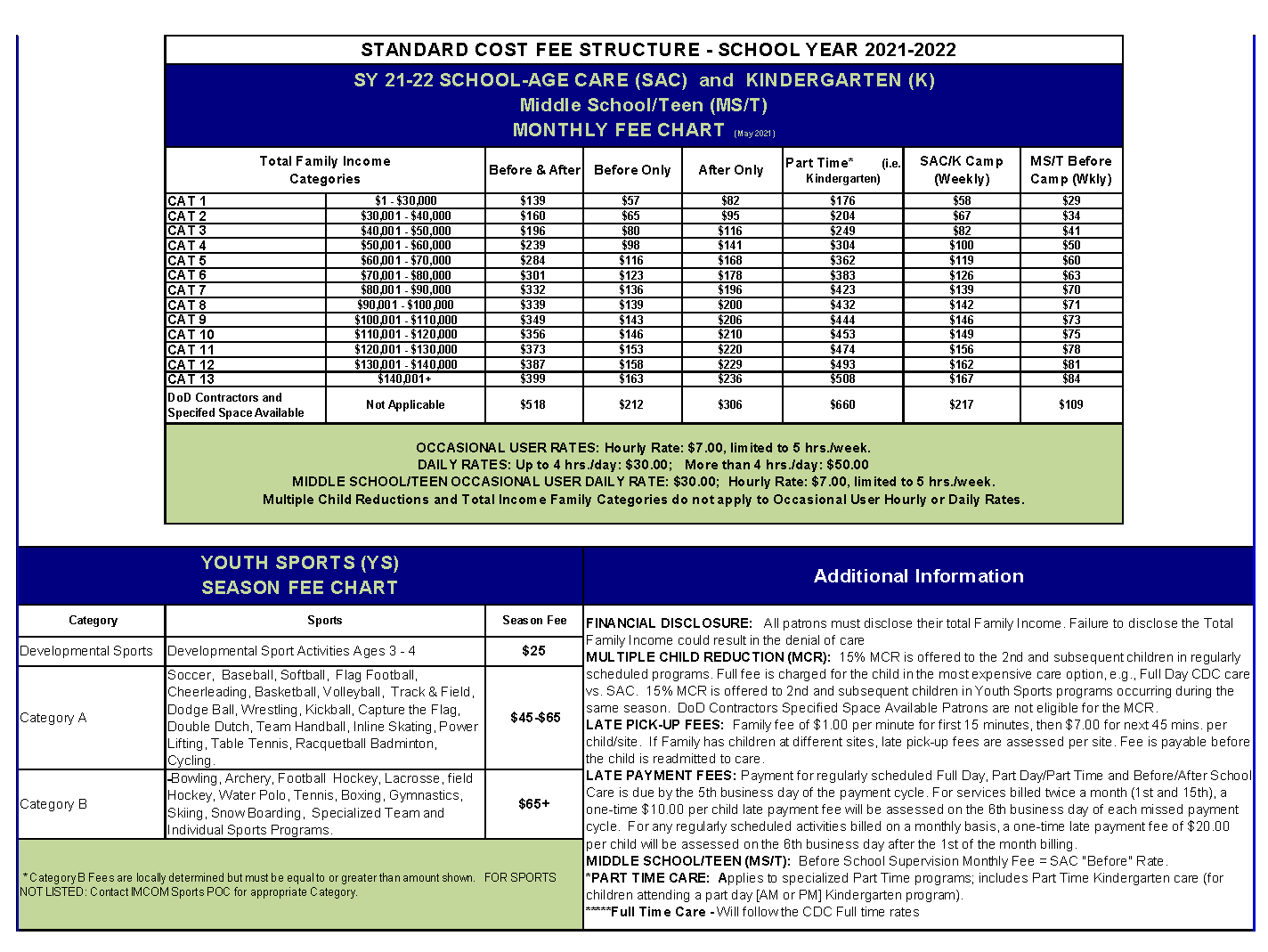

Army Cys Fee Chart 2021 Army Military

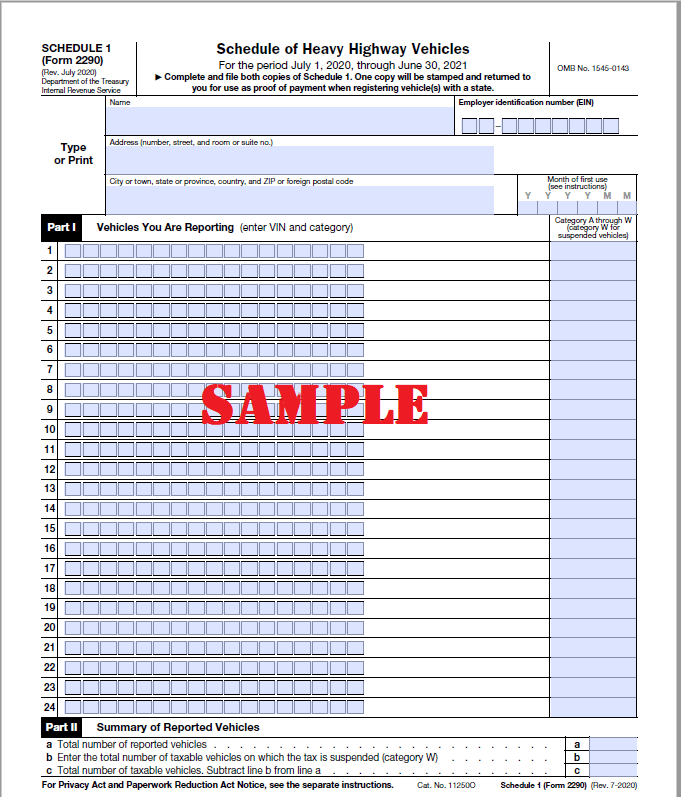

How to Get Form 2290 Schedule 1, proof of HVUT Payment in Minutes

Schedule 1 IRS Form 2290 Proof of Payment

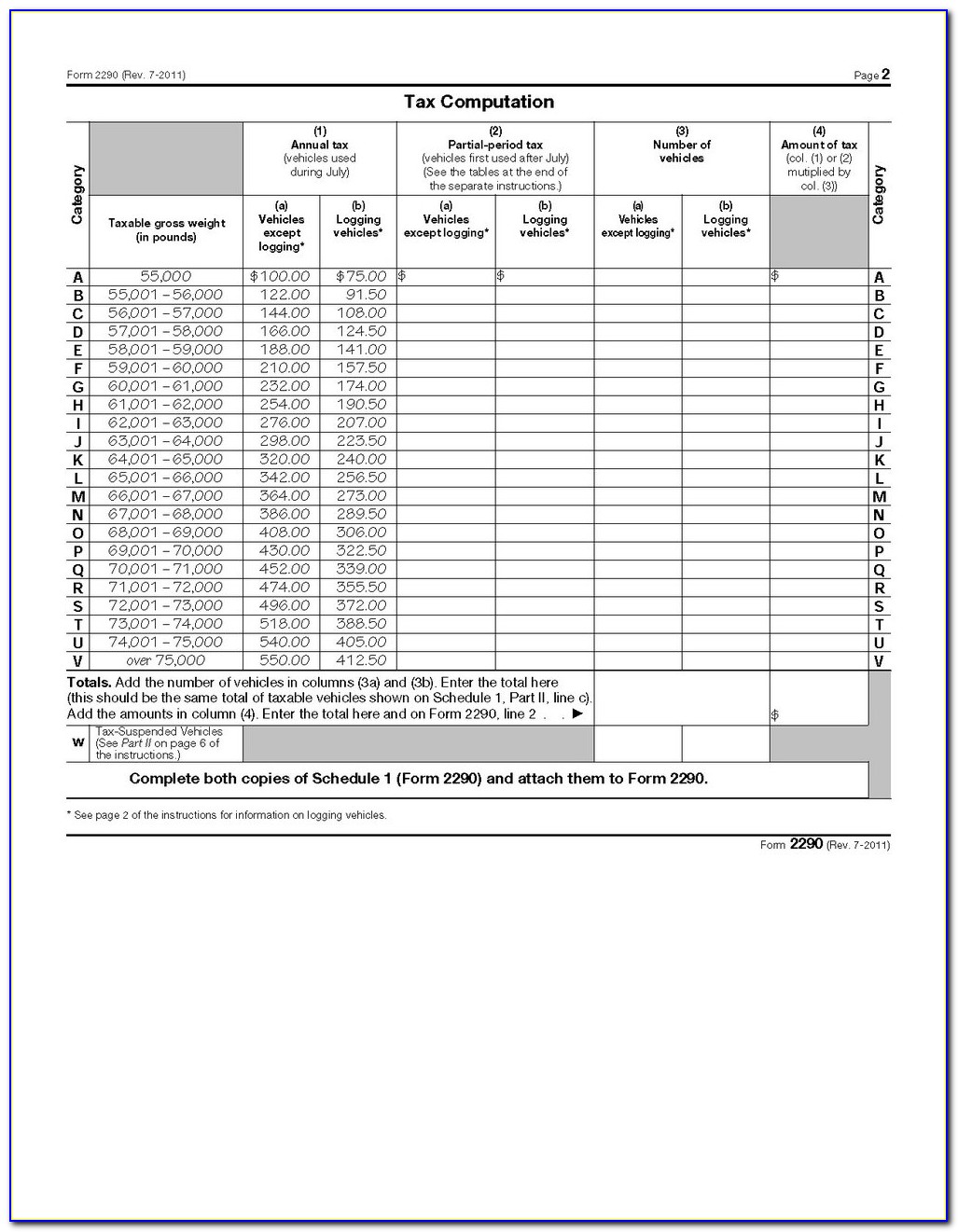

Figuring the IRS Tax for Form 2290 for Tax Year 20112012

Form 2290 Instructions In Normal People Language

Printable 2290 Form

IRS Form 2290 Due Date For 20232024 Tax Period

Web Simply Enter Your Vehicle Weight And Use Type, And Our App Will Immediately Calculate Your 2290 Tax Amount.

Web For Vehicles Purchased From A Seller Who Has Paid The Tax For The Current Period:

Web Calculating Fees (Fees Are Based On Gross Taxable Weight Per Vehicle):

Form 2290 Amendment (Taxable Gross Weight Increase + Mileage Exceeded) $ 19.95.

Related Post: