20 Pip Challenge Chart

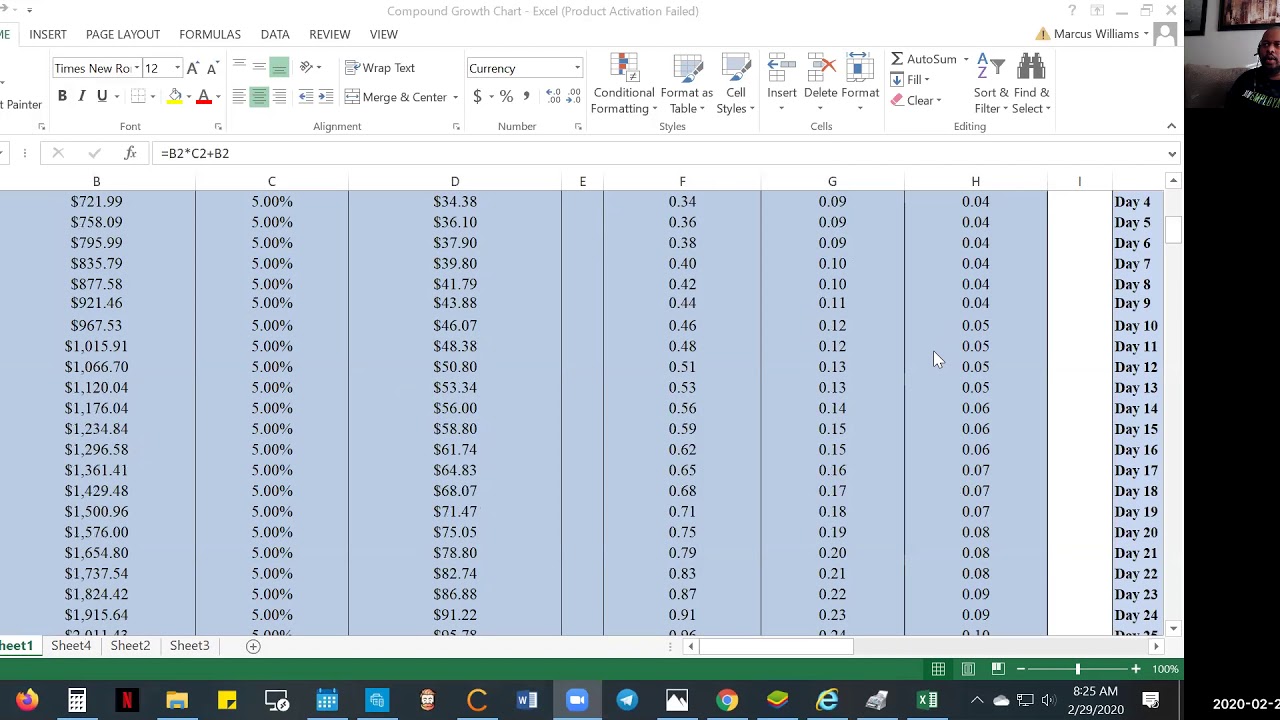

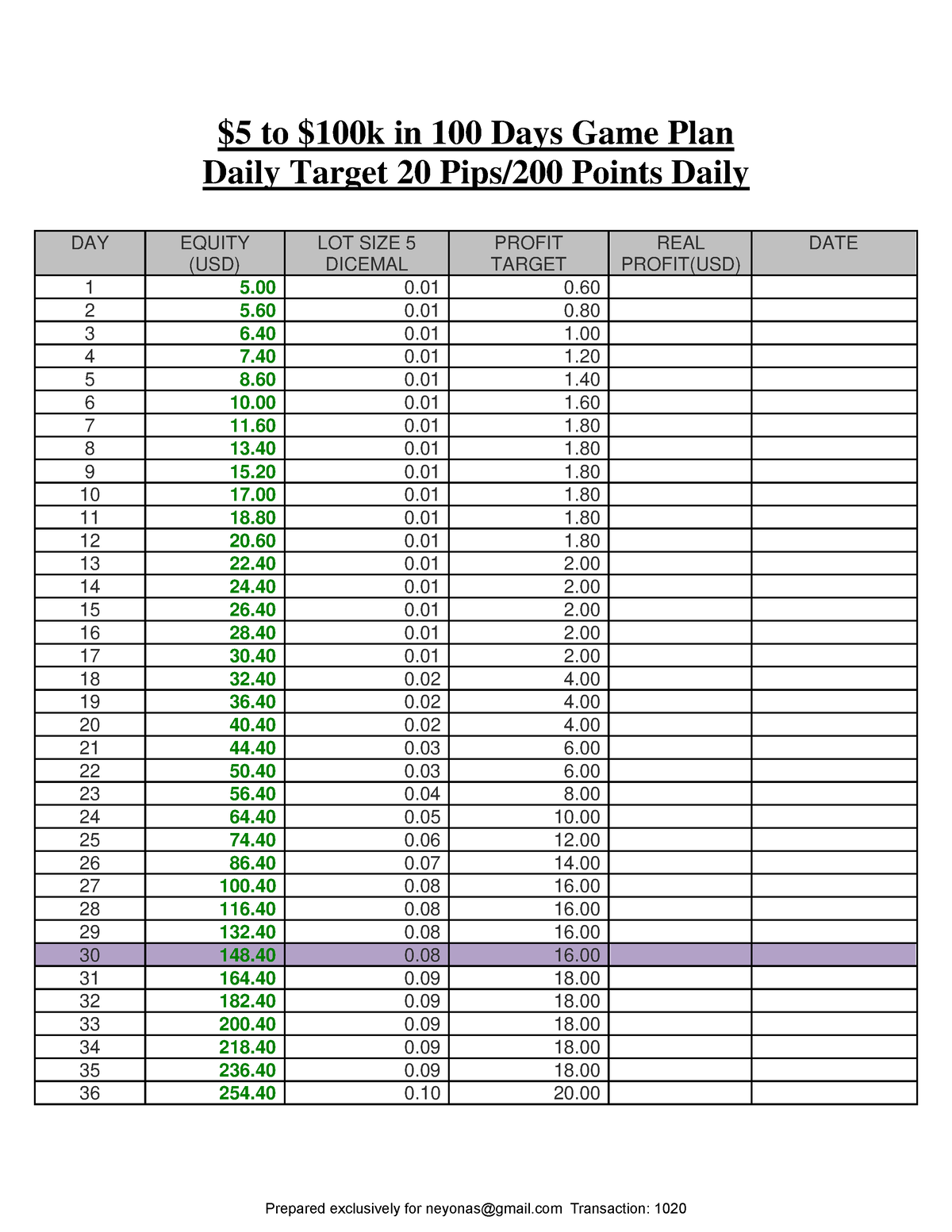

20 Pip Challenge Chart - Web question about the 20 pips challenge ask question. Web master the forex 20 pip challenge to refine your trading prowess and consistently secure gains in the currency market. Here you can converse about trading ideas…. Use the 5 minute chart. I am trying to do the 20 pips challenge, where you starts a trading account with small money (here 1000 euros account, but you trade only 2%, i.e 20 $) and where you try to make 20 pips at each trade. Spread betting simplifies the approach to trading. Web americans’ views of technology companies. How to trade the 20 pips strategy. I feel like this is something a lot of people don't understand about this challenge. Web looking for a spreadsheet for the 20 pip challenge not very good with excel or the formulas i am in the united states so i need the leverage @ 50:1. Scribd is the world's largest social reading and. The document outlines 30 levels of a trading plan, listing the starting balance, risk percentage, profit goal, number of pips needed to hit the profit target, and recommended lot size for each level. This target is based on the observation that the forex market often presents enough volatility to extract these profits.. Use the 5 minute chart. The goal is to make 20 pips within a specific time frame , typically within a day, and to do so with a. Web the 20 pip challenge is you start with 20 dollars and make 20 pips everyday (30% gains) and you end up with 52k in 30 days…. Web the premise of the. Web americans’ views of technology companies. 2) in order to average 20pips a day.you are more than likely going to have to win at least 40pips on your winning trades to offset your losses. Web simple 20 pip challenge to take your account from $20 to $50,000 in 30 days trading forex.stick to the rules for a safe way to. The document outlines 30 levels of a trading plan, listing the starting balance, risk percentage, profit goal, number of pips needed to hit the profit target, and recommended lot size for each level. Web question about the 20 pips challenge ask question. It shows that as the account balance increases, the dollar and lot amounts required per pip also increase.. Spread betting simplifies the approach to trading. Welcome to fxgears.com's reddit forex trading community! Still, republicans stand out on several measures, with a majority believing major technology companies are biased toward liberals. How to trade the 20 pips strategy. Sl must be clear before. Below is a step by step process to trade this strategy. Forex compounding strategy daily pips target. Web looking for a spreadsheet for the 20 pip challenge not very good with excel or the formulas i am in the united states so i need the leverage @ 50:1. Most americans are wary of social media’s role in politics and its. So depending on the trade your sl might be 5 pips or it might be 80. Afterall, spread betting is about the size of your bet so 20 pips is equal across all currency pairs if your bet size is the same. Web it would depend what pair/instrument you decide to trade that determines the leverage required to open those. Doesn't matter if it's one day before or one second before. Web the 20 pips challenge is a trading challenge that involves making a profit of 20 pips on a single trade or within the same day. Web this document outlines the dollar and lot amounts required per pip movement for different account balances when trading forex. Most americans are. Web simple 20 pip challenge to take your account from $20 to $50,000 in 30 days trading forex.stick to the rules for a safe way to make profits fast only risking. Web 1) first you have to find a consistant system. Scribd is the world's largest social reading and. Web the 20 pips challenge is a trading challenge that involves. 2) in order to average 20pips a day.you are more than likely going to have to win at least 40pips on your winning trades to offset your losses. Web this document outlines the dollar and lot amounts required per pip movement for different account balances when trading forex. Web the table calculates these values for different numbers of lots per. Forex compounding strategy with an interest rate. Welcome to fxgears.com's reddit forex trading community! The 20 pip challenge is a trading strategy for the forex market in which you can grow an account from just $20 to $50,000 over the course of 30 trades. The goal is to make 20 pips within a specific time frame , typically within a day, and to do so with a. Web in this section, you can download our free forex compounding trading plan pdf, which includes two forex compounding strategies: So depending on the trade your sl might be 5 pips or it might be 80. Web the 20 pip challenge ($50,000 in 30 trades) + spreadsheet. Web americans’ views of technology companies. I feel like this is something a lot of people don't understand about this challenge. Web use 20 pip stoploss you only take your profit for 10 pip for the day, that’s all. It shows that as the account balance increases, the dollar and lot amounts required per pip also increase. Here you can converse about trading ideas…. Just take 1 trade per day , 2 at max if your lucky. 3) compounding is great but, what about un expected losses? Modified 2 years, 1 month ago. Doesn't matter if it's one day before or one second before.

20 PIPS A DAY or PER TRADE (Using The Agimat) 30020k in 90 Days YouTube

20 to 50,000 20 Pip Challenge Forex YouTube

The 20 Pip Challenge

Explaining Psychology behind the 20 pip challenge. r/Forex

20 Pips Challenge PDF

20 Pips Challenge PDF

Forex 100 to million challenge/ 20 pip spreadsheet. YouTube

20 Pips A Day Forex Trading Strategy. Will It Make You Rich?

5 dollar trading plan 5 to 100k in 100 Days Game Plan Daily Target

20 Pips a Day Forex Scalping Strategy

Web Looking For A Spreadsheet For The 20 Pip Challenge Not Very Good With Excel Or The Formulas I Am In The United States So I Need The Leverage @ 50:1.

This Target Is Based On The Observation That The Forex Market Often Presents Enough Volatility To Extract These Profits.

Sl Must Be Clear Before.

Web It Would Depend What Pair/Instrument You Decide To Trade That Determines The Leverage Required To Open Those Lot Sizes With Specific Margin Requirements.

Related Post: