1099Nec Printable

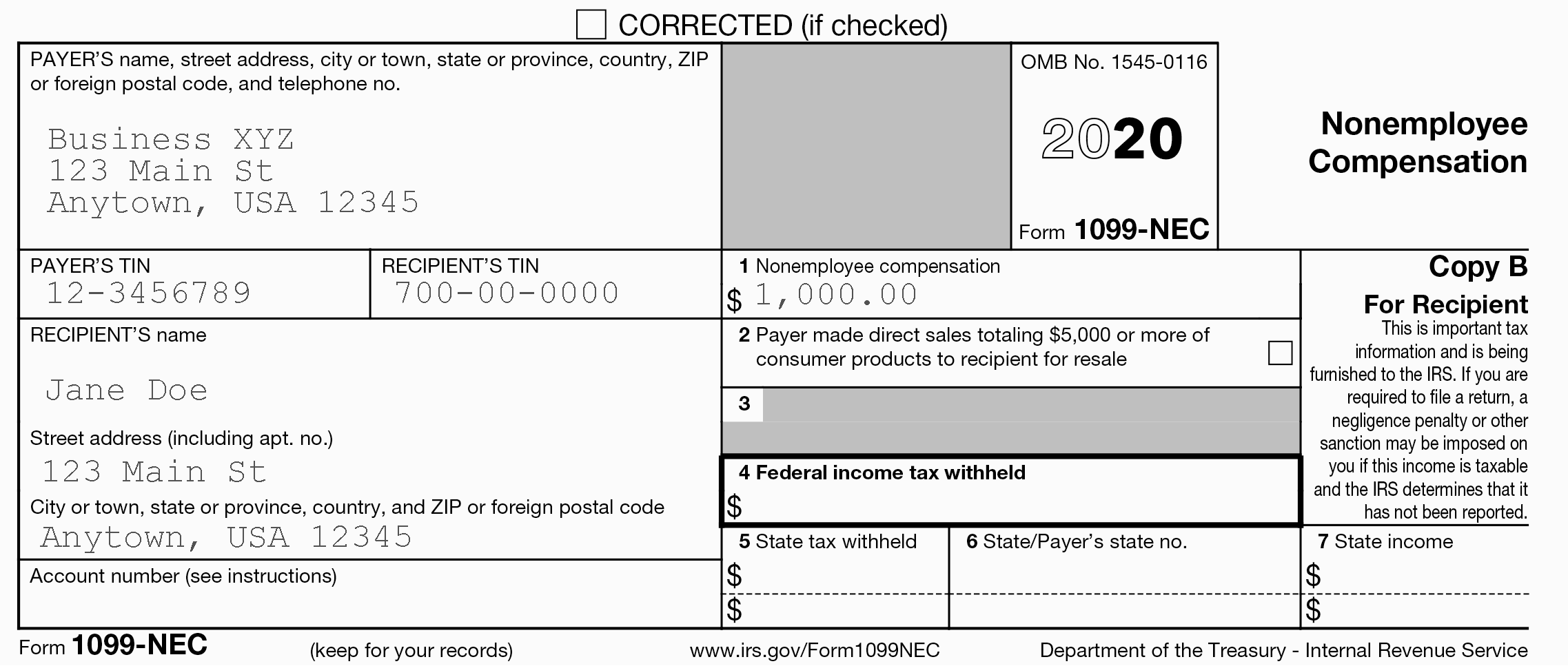

1099Nec Printable - Copy a of this form is provided for informational purposes only. Simple instructions and pdf download. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Current general instructions for certain information. Updated on january 12, 2022. Onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. For internal revenue service center. Web updated november 27, 2023. Services performed by a nonemployee (including parts and materials) Page last reviewed or updated: To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Businesses fill out this form for each individual to whom they pay. Simple instructions and pdf download. Copy a appears in red, similar to the official irs form. Copy a appears in red, similar to the official irs form. Businesses fill out this form for each individual to whom they pay. To order these instructions and additional forms, go to www.irs.gov/employerforms. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is. This documents the. Current general instructions for certain information. For internal revenue service center. Simple instructions and pdf download. File to download or integrate. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is. Businesses fill out this form for each individual to whom they pay. Our quick guide gives you the highlights. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically.. Copy a of this form is provided for informational purposes only. Web updated november 27, 2023. Services performed by a nonemployee (including parts and materials) Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. For internal revenue service center. Web 10 or more returns: This form is used by businesses to report payments made to nonemployees, like independent contractors or freelancers. Copy a appears in red, similar to the official irs form. For internal revenue service center. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this. File to download or integrate. Copy a appears in red, similar to the official irs form. Updated on january 12, 2022. An undated form means a simpler tax year. Copy a of this form is provided for informational purposes only. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Copy a appears in red, similar to the official irs form. To ease statement furnishing requirements, copies b, c, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Businesses fill out this form for each individual to whom they pay. Web updated november 27, 2023. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format. This documents the income they received from you so it can be properly reported on their tax return. Services performed by a nonemployee (including parts and materials) An undated form means a simpler tax year. Web updated november 27, 2023. Onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Businesses fill out this form for each individual to whom they pay. This documents the income they received from you so it can be properly reported on their tax return. Copy a appears in red, similar to the official irs form. To ease statement furnishing requirements, copies b, c, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Services performed by a nonemployee (including parts and materials) Current general instructions for certain information. File to download or integrate. This form is used by businesses to report payments made to nonemployees, like independent contractors or freelancers. Because paper forms are scanned during processing, you cannot file certain forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Copy a of this form is provided for informational purposes only. The official printed version of copy a of this irs form is scannable, but the online version of it, printed from this website, is. Simple instructions and pdf download. For internal revenue service center. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Our quick guide gives you the highlights.

Irs 1099 Nec Form 2023 Printable Free

1099nec Form 2021 Printable

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

1099Nec Template Free

IRS Form 1099NEC Non Employee Compensation

1099 NEC Editable PDF Fillable Template 2022 With Print and Clear

![]()

Printable Form 1099nec

1099 Nec Form Printable Printable Forms Free Online

How to File Your Taxes if You Received a Form 1099NEC

1099 Nec Printable Form Francesco Printable

Onpay’s Goal Is To Make It Easier For Small Business Owners To Take Care Of Payroll, Hr, And Employee Benefits.

Starting Tax Year 2023, If You Have 10 Or More Information Returns, You Must File Them Electronically.

Updated On January 12, 2022.

An Undated Form Means A Simpler Tax Year.

Related Post: