1099 Misc Forms Printable

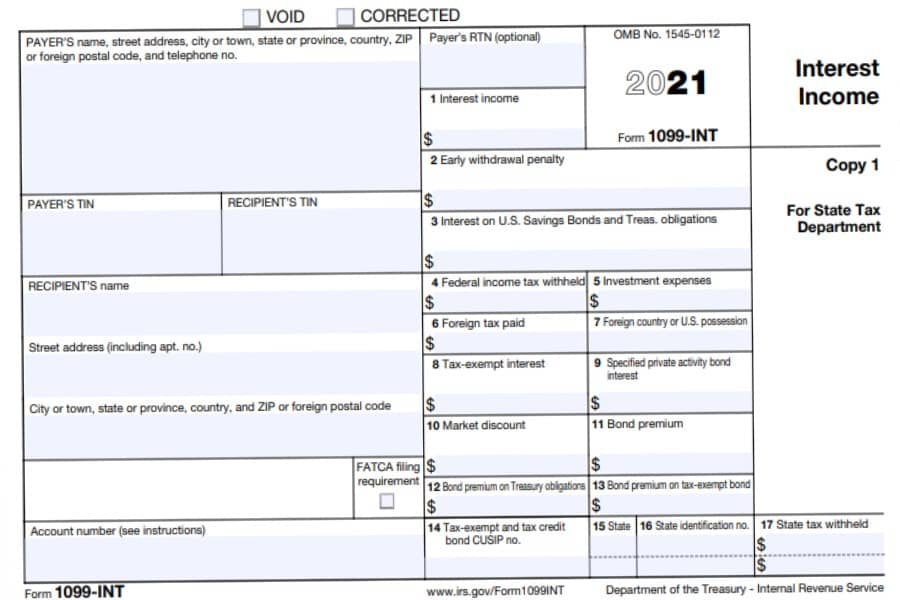

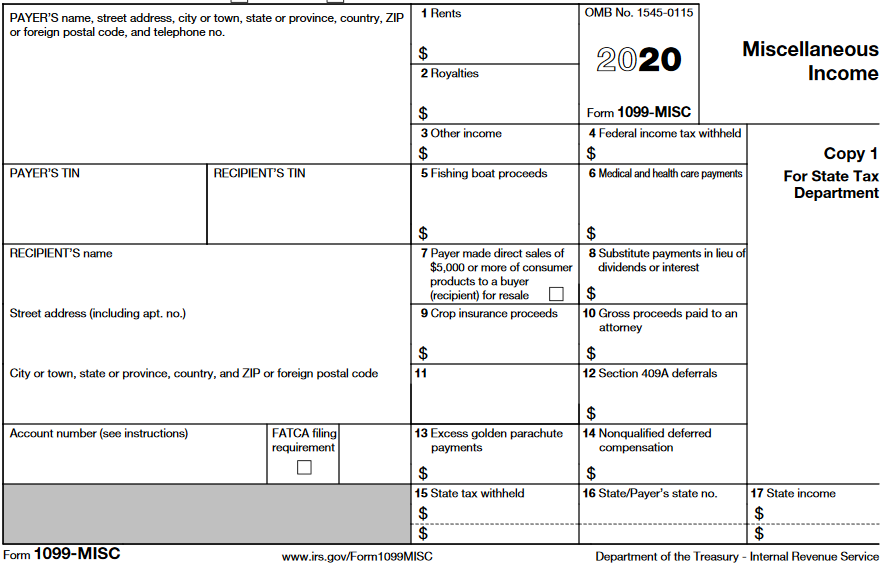

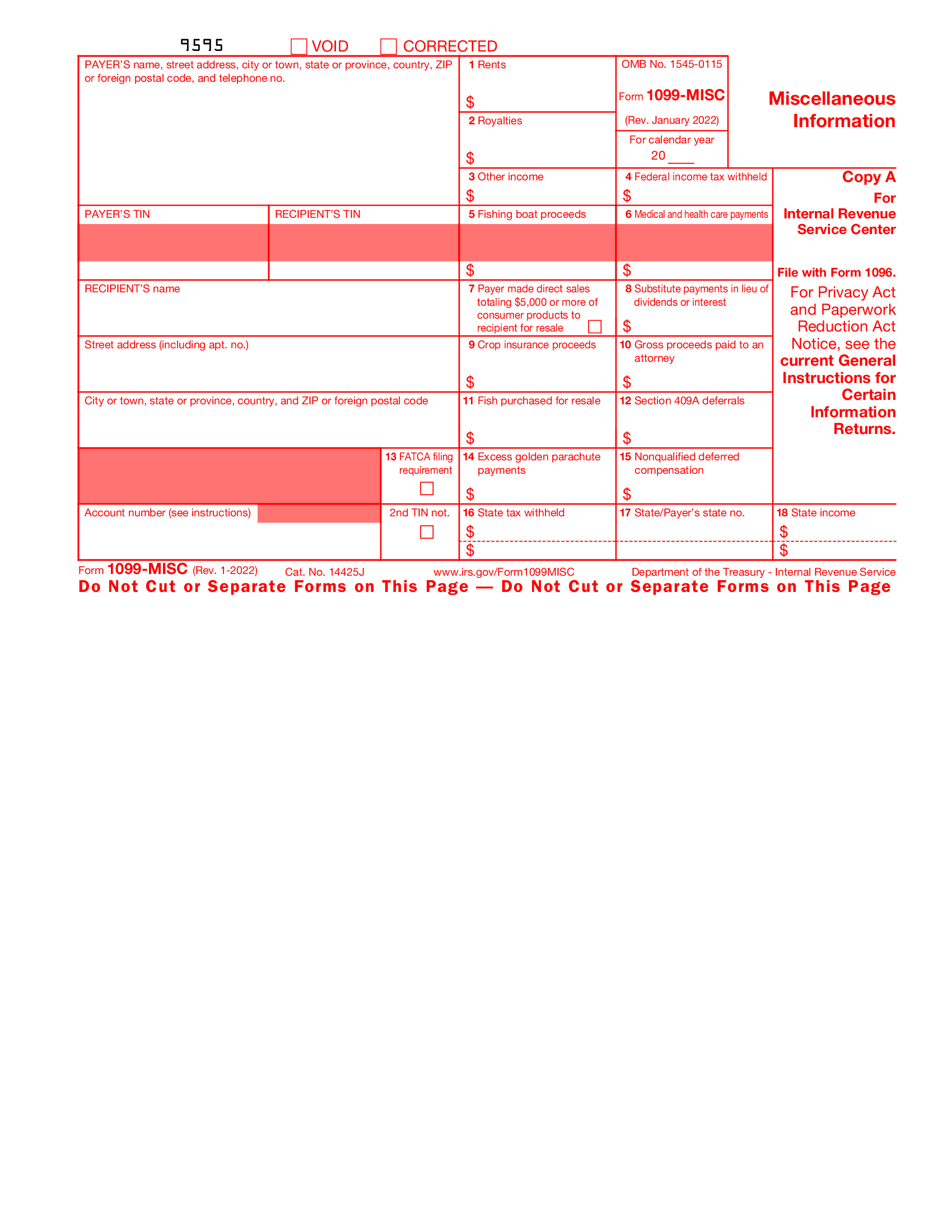

1099 Misc Forms Printable - For privacy act and paperwork reduction act notice, see the. Pricing starts as low as $2.75/form. Web irs 1099 form. 31, 2024, to report 2023 calendar year payments. Copy a appears in red, similar to the official irs form. The other major difference is that your employer withholds tax from your paycheck to cover your tax liability all year long. Select state you’re filing in. Cash paid from a notional principal contract made to an individual,. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous compensation,. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. For privacy act and paperwork reduction act notice, see the. Their full legal name and address. Printable from laser and inkjet printers. Copy a appears in red, similar to the official irs form. Web click to expand. Copy a of this form is provided for informational purposes only. For internal revenue service center. 31, 2024, to report 2023 calendar year payments. Other items you may find useful. Select state you’re filing in. The official printed version of copy a of this irs form is scannable, but the online version of. 1099 forms can report different types of incomes. For internal revenue service center. Cash paid from a notional principal contract made to an individual,. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income. Quick & secure online filing. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. For internal revenue service center. The other major difference is that your employer withholds tax from your paycheck to cover your tax liability all year long.. The official printed version of copy a of this irs form is scannable, but the online version of. Your employer is responsible for the other 7.65%. Gather information for all of your payees. For privacy act and paperwork reduction act notice, see the. 2020 general instructions for certain information returns. What it is, how it works. Please don't hesitate to drop me a reply below if you have additional concerns or. Printable from laser and inkjet printers. 31, 2024, to report 2023 calendar year payments. Your employer is responsible for the other 7.65%. Web print your 1099 and 1096 forms. The official printed version of copy a of this irs form is scannable, but the online version of. Gather information for all of your payees. Printable from laser and inkjet printers. 31, 2024, to report 2023 calendar year payments. Gather information for all of your payees. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. The official printed version of copy a of this irs form is scannable, but the online version of. 31, 2024, to report 2023 calendar year payments. The other major difference is that your employer withholds tax. Web irs 1099 form. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. File to download or integrate. The other major difference is that your employer withholds tax from your paycheck to cover your tax liability all. For privacy act and paperwork reduction act notice, see the. Your employer is responsible for the other 7.65%. Receipts, invoices and any other payment information. Miscellaneous income (or miscellaneous information, as it’s now called) is an internal revenue service (irs) form used to report certain types of miscellaneous compensation,. 31, 2024, to report 2023 calendar year payments. Web irs 1099 form. Please don't hesitate to drop me a reply below if you have additional concerns or. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and. Receipts, invoices and any other payment information. Here are some articles that offer additional information about preparing 1099 forms within the program: For privacy act and paperwork reduction act notice, see the. For internal revenue service center. Printable from laser and inkjet printers. The treatment of amounts reported on this form generally depends upon which box of the form the income is reported in. Corrected for privacy act and paperwork reduction act notice, see the. Form 1099 is a collection of forms used to report payments that typically aren't from an employer. Other items you may find useful. Quick & secure online filing. Select state you’re filing in. Your employer is responsible for the other 7.65%. These can include payments to independent contractors, gambling winnings, rents, royalties, and more.

1099MISC Form Template Create and Fill Online

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Printable Form 1099 Misc For 2021 Printable Form 2024

How to Fill Out and Print 1099 MISC Forms

What is a 1099Misc Form? Financial Strategy Center

Your Ultimate Guide to 1099MISC

Form 1099MISC for independent consultants (6 step guide)

Fillable 1099 Misc Irs 2022 Fillable Form 2024

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

Form 1099 Misc Fillable Form Printable Forms Free Online

Payments Above A Specified Dollar Threshold For Rents, Royalties, Prizes, Awards, Medical And Legal Exchanges, And Several Other Specific Transactions Must Be Reported To The Irs Using This Form.

For Privacy Act And Paperwork Reduction Act Notice, See The.

2019 General Instructions For Certain Information Returns.

8 1/2 X 11 Item Numbers:

Related Post: